How to Stop Comenity Bank Harassment of Debt

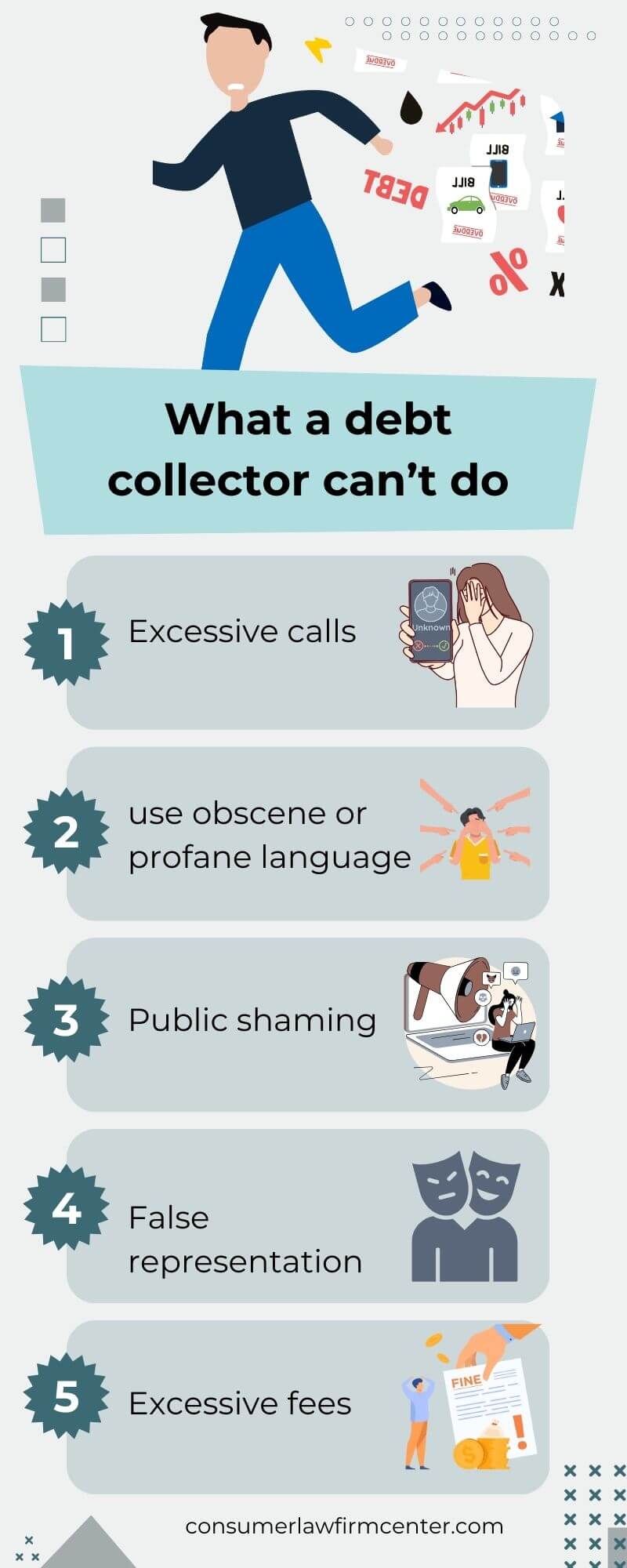

If your creditors’ calls are stressing you out and causing distress and trauma, then you are facing Comenity Bank harassment, even if you owe money. Actions not allowed under the FDCPA and TCPA. This behavior includes:

- I’m just visiting you at places you have not allowed access to, such as your workplace or residence.

- Debt collectors cannot make threats of harming you in person or abusing you over the telephone verbally.

- Debt collectors cannot threaten you with legal action, which may not be applicable to your case at all.

- Debt collectors cannot misrepresent the truth about your debt, intentionally providing you with false ‘information’ regarding the debt you owe.

- Third-party debt collectors cannot share information about your debt with another person or inform the person who answers the phone or your door about your debt. Leaving a message regarding details of your debt with friends, relatives, or unauthorized persons.

- Debt collectors cannot communicate your debt on social networks like Facebook.

- Falsifying paperwork that scares you into believing that your debt is now a police or court matter is an offense.

- Debt collectors should not suggest ways in which you can pay off the debt (including selling your home or taking on another line of credit) without your permission.

- Debt collectors cannot misrepresent their identity by posing as officers of the court.

- Debt collectors cannot issue threats to have you arrested or to take away your property for the fulfillment of the debt.

- Debt collectors cannot engage in unfair practices, such as depositing a post-dated check before the due date.

- Debt collectors cannot collect interest or fees that are above the debt.

- In the case of a bank loan, it also constitutes harassment if the collection agents are using bank numbers to make phone calls for debt recovery.

Is Comenity Bank charging you late fees❓

Have you ever paid your bill over the phone with a live agent and were still charged a late fee when you were on time? If you feel as though they are charging you late fees and you should not be held responsible, then call us now at (877)700-5790.

Are they calling you many times per day? If so, then call and speak to one of our intake specialists.

Are you having issues with settling disputes with Comenity? If any of these issues are happening, feel free to contact our office now.

Who is Comenity Bank❓

Comenity Bank is one of the major credit card companies in the United States today. The company offers both credit and debit card services to over 93 retail stores across America using largely store-branded credit cards. With a clientele of over 150 retailers, this institution has been connecting consumers to their favorite retailers for over 30 years. Since the company has an in-house collection and billing department, Comenity Bank debt collection harassment and phone harassment have become very common among consumers who owe unsettled debts to the company. Besides the horrors faced by many consumers dealing with Comenity Bank harassment and debt collection, there have also been several allegations of scams, financial crimes, and breaches of laws such as the TCPA by the agency.

🏛️ Bread Financial Address: PO Box 182273, Columbus, Ohio 43218

Common Comenity Bank Store Credit Cards

- ➡️ Forever 21 Credit Card

- ➡️ Express card

- ➡️ Zales Diamond Card

- ➡️ Ashley Stewart card

- ➡️ Woman Within Credit Card

- ➡️ Comenity Bank Torrid Card

- ➡️ Comenity Bank Wayfair card

- ➡️ Ulta card

- ➡️ Total Rewards Card

- ➡️ Victoria Secret Card

What Does Not Count As Comenity Bank Harassment Debt Collection❓

Since we cannot classify all your interactions with Comenity Servicing LLC as Comenity bank harassment, it is important to also let you know what is not classified as debt collection agency harassment. Under the law, a debt collection agency can make reasonable efforts to collect what you owe them, provided that they do not abuse, threaten, or harass you in the process. So, if they keep calling, you should know that it is within their right to contact you over the repayment of a debt you owe. Harassment does not include:

- ➡️ Sending you notifications to remind you about your debt.

- ➡️ Robocalls that you have consented to.

- ➡️ A debt collection representative is calling to discuss the status of your debt.

- ➡️ Visiting your address at a reasonable time of the day or sending letters via mail.

- ➡️ Taking legal action against you over your failure to respond.

How to stop calls from Comenity Bank

Fortunately, there are rules in place to stop debt collector harassment from causing trauma and emotional distress. As a consumer, you need to know what you can do to prevent yourself from going through the emotional trauma of unfair debt collection. The Fair Debt Collection Practices Act and the Telephone Consumer Protection Act regulate debt collection practices and protect consumers.

FDCPA

The FDCPA states that harassment in any form is unacceptable, while the TCPA regulates the use of automated equipment to make consumers make robocalls and send text messages. Like the FDCPA, the TCPA also protects the rights of consumers in the face of debt-related harassment.

How to Write a Cease-and-Desist Letter❓

Writing a cease and desist letter is a skill that requires specific knowledge due to the technicalities involved. We usually advise that you hand the process over to a qualified consumer rights lawyer or attorney to do it on your behalf. Nevertheless, technology and the Internet of Things have made it a lot easier to do by providing you with information and a framework on how to go about writing a cease-and-desist letter. By the look of things, you may be able to write a cease and desist letter by yourself. However, getting a professional to draft one up for you may be 10 times more effective, as there may be intricacies you do not know about.

To write a cease-and-desist letter, all you have to do is write your name and address, write the debt collector’s name and address, the reason why you would like them to stop the harassment, and send it via certified mail. Request a return receipt as evidence your letter has been received. Need a professional to construct an effective cease-and-desist letter on your behalf? Call us now at (877)700-5790 to start the process.

Why Hire a Professional❓

The FDCPA does not protect all kinds of debts. Furthermore, there could be a thin line between what is legal for the debt collectors and what constitutes willful harassment. A professional can help you navigate the different aspects of your debt better and also help you deal realistically with the issue of harassment, thus Addressing your distress directly and helping reduce the stress you are likely to encounter.

What If I Have Already Settled My Debt❓

The bank cannot contact you for debts that have been settled or discharged in bankruptcy. If the Comenity bank or collections are calling you with information about a debt that you do not owe or store credit card that you do not remember acquiring, here are a few things that you should do:

- Inform the caller that the alleged debt has been resolved or discharged into bankruptcy. Tell them that it may be a mix-up somewhere, and politely ask that they look into it.

- You are entitled to a debt validation letter; ask for it. They are required to send this letter to you within 5 days of their initial contact with you.

- Go through the records you have on your end to confirm if the debt actually exists, how much it is, and if it has already been resolved or settled. Examples of records to review involve old account statements and copies of canceled checks. Be sure to keep them handy as well because you may need them in court.

- Check your records with the credit bureaus. If the debt exists, it was probably reported to the credit bureaus.

Why is Comenity Bank calling me when I do not owe them❓

Suppose you are on the receiving end of debt collection calls but do not remember incurring any debts with a creditor or any of its affiliated merchants. In that case, you may be falling victim to one of the many reported credit card or other bank-calling scams. To avoid scam calls, ask the caller to send you verification of the debt that they claim you owe or leave you alone. This should put an end to the fake phone calls you have been receiving.

Comenity Bank Harassment Phone Numbers

from any of these numbers? 614-729-6090, 303-255-5349, 303-255-5352, 303-255-5354, 614-212-5293, 913-563-5511, 720-456-3687, 913-563-5510, 614-729-6087, 614-729-5609, 614-754-4136, 800-695-2912, 614-534-2516 800-251-1344, 913-312-9496, 901-881-9965, 650-200-1467, 866-326-0809, 202-417-2116, 360-868-6188, 303-255-5348, 800-695-2912, 614-534-2516 614-212-7500, 800-695-2912, 614-534-2516, 720-728-3217, 844-271-2816, 614-729-6086, 614-754-4132, 614-754-4056 614-534-2515, 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132, 614-754-4056 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132, 877-475-3483, 614-754-4056, 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132 844-271-2816, 614-212-7500, 913-577-5000, 614-534-2515, 614-729-6091, 614-754-4060, 614-729-5609, 614-754-4132, 801-438-8376, 208-719-3271, 303-255-5054, 614-729-7086, 614-754-4056, 614-754-4132, 614-729-5609, 614-212-5292, 614-754-4060, 888-393-7162, 303-209-2049, 614-729-9031, 855-497-8174, 800-695-2912, 614-534-2516 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132.

614-754-4056, 614-212-7500, 614-534-2515, 614-754-4137, 614-729–7086, 614-754-4060, 303-255-5054 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132, 614-754-4056, 614-212-7500, 614-534-2515, 614-754-4137, 614-729-7086, 614-754-4060, 303-205-5054 614-729-3989, 720-456-3679, 720-456-3744, 720-456-3742, 720-456-3741, 720-456-3740, 720-456-3711, 720-456-3682, 855-497-8173, 614-212-7532, 612-212-7530 , 800-695-2912, 614-534-2516, 614-729-3989, 720-456-3679, 720-456-3744, 720-456-3742, 720-456-3741, 720-456-3740, 720-456-3711, 720-456-3682, 855-497-8173, 614-212-7532, 612-212-7530 844-271-2816, 614-212-7500, 913-577-5000 614-754-4135, 614-754-4132, 614-212-5291, 913-312-3216, 913-312-9502, 720-456-3682 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132 614-212-7500, 800-695-2912, 614-534-2516, 844-271-2816, 614-729-6086, 614-754-4132, 614-754-4056, 614-212-7500, 614-534-2515, 614-754-4137, 614-729-7086, 614-754-4060, 303-205-5054, 208-719-3271, 801-438-8376, 614-729-9037, 800-675-5685, 855-796-9632, 888-332-4728, 888-819-1918,800-695-1788, 886.925.7109, 800.772.1413, 886-925-7109, 800-675-5685, 855-506-2496, 844-271-2552, 800-821-5744, 720-356-3688, 732-806-3199, 609-400-7010, 614-729-9025.

More Numbers:

614-729-9031, 913-312-9488, 800-305-1215, 855-334-4198, 614-729-4000, 614-729-7670, 614-729-6040, 913-563-5522 ,303-255-5045, 800-695-9478, 800-220-1181, 800-854-67-55, 800-869-3557, 833-755-4354, 800-695-9583, 866-789-4961, 800-695-9583, 1866-427-428, 800-367-3647,800-981-7490, 888-819-1918, 1-800-675-5685, 888-245-4064, 800-695-1788, 800-376-0581,1-800-967-1398, 800-926-5393,866-907-5594, 800-695-1788, 844-271-2757, 1-844-271-2758, 877-362-7264,888-566-4353, 855-269-1622,1-844-271-2535 1-877-258-6953,1-855-567-7738, 844-271-2778, 855-506-2496, 888-621-3809, 866-308-0681, 855-617-8084, 855-603-5666, 855-567-7741, 866-832-8035, 800-995-9450, 800-395-3780, 1-866-254-9967, 888-774-8661, 855-463-6345, 800-695-5258, 866-258-0114,866-828-7755, 888-819-1918, 866-891-3458, 1-866-843-0194.

800-387-9098, 855-408-1657, 855-266-0556, 614-729-3000, 844-271-2708, 866-507-6744, 866-810-3618, 866-507-6744, 866-810-3618, 800-201-4955, 800-767-1309, 866-512-6286, 866-284-2764, 866-283-6797, 888-252-5484 855-497-8168, 866-353-2214, 866-285-1323, 866-327-4367, 866-534-4180, 866-869-9354, 866-322-1316, 866-832-8041, 866-482-4479, 844-271-2559, 855-567-7743, 855-842-9240, 888-724-6649, 866-327-4425, 855-408-1662, 888-428-8810, 888-866-8932, 855-334-3649, 800-329-9713, 888-245-4124, 800-695-0466, 844-271-2522, 800-888-4163, 855-506-2496, 844-271-2688, 888-427-7785, 800-474-7552, 866-884-9859,1-866-907-5612, 877-756-1958, 866-308-0680, 347-374-1555, 614-754-4073, 720-456-3687, 855-437-5016, 913-312-3217, 886.925.7109, 855-408-1658,844-271-2794, 855-408-1658, 844-271-2794, 844-271-2653, 800-695-8045, 855-334-3686, 855-334-3613,866-303-5087, 888-275-2480, 888-275-2480, 866-888-1569, 800-889-0494,

800-362-8430, 855-497-8157, 1-800-695-1219, 800-304-8710, 877-851-3123, 800-367-9284, 800-723-4548, 800-252-1849, 844-271-2718, 800-767-3662, 866-234-2029, 800-217-8071, 866-807-9835, 800-695-0195, 866-283-1065, 866-522-8014, 800-927-3783, 844-271-2543, 877-206-7862, 888-724-6649, 877-287-8879 866-271-2409, 888-252-5557, 800-324-0324, 866-230-7070, 866-234-2038, 844-271-2678, 800-367-9284, 800-723-4548, 888-621-3813, 800-315-7260, 800-853-2921, 866-322-1316, 855-381-5715, 866-662-6199, 855-835-8414, 844-271-2665, 866-392-5825, 888-428-8818, 866-279-1485, 855-839-2900, 800-695-9478, 844-271-2567, 800-695-3988, 844-271-2823, 888-621-3815, 866-776-9859, 866-254-9971, 855-567-7745, 844-271-2708, 877-622-5314, 720-456-3695, 614-729-9026, 614-729-9043, 913-677-8365, 614-534-2520, 208-719-3274, 913-677-8365, 614-729-9043, 303-323-8692, 505-253-0592, 614-729-9041, 513-707-6993, 801-438-8379, 720-456-3768, 614-729-9041, 720-456-3768, 800-695-0019, 614-729-9041, 614-534-5420, 801-438-8379, 614-534-2547, 877-475-3483, 888-865-0828, 614-754-4060, 720-456-3745, 855-957-3119, 913-677-8323, 913-677-8324, 614-729-6088, 303-255-5109, 720-728-3218, 614-212-7504, 614-754-4074, 913-312-0548, 614-212-5166, 614-212-7056, 913-312-5098, 913-563-5523, 913-677-8323, 913-677-8324, 913-563-5507, 614-729-5385, 208-719-3279, 614-729-9021, 913-312-0990.

Are You a Victim?

If the answer is yes, then you are receiving calls from the phone numbers above. You may be a victim of Bank phone harassment. The list above is not all the numbers that Bread Financial uses. The calls can be from different cell phone call numbers and still be the bank calling you.

Cardholders might also receive text messages from these numbers in relation to collecting credit card debt. Stop the automated calls and unsolicited text messages. Phone Harassment is a violation of the Telephone Consumer Protection Act, which would be illegal. Regain your peace of mind while ensuring the debt collectors pay for their willfulness. Contact our office right away so we can start the process to stop the Bank from calling you illegally. No one should live with harassment! Consumer Rights Law Firm, PLLC is a law firm that specializes in helping clients who are facing harassment from debt collectors in any form, including telephone communication. If you are dealing with harassment, call us for immediate assistance.

More about Comenity Bank Harassment

Debt collection is a pretty uncomfortable place to be in. If you are currently receiving threats instructing you to pay up a debt that you are not sure you owe. Be sure that you verify the various third-party debt collectors to avoid a scam. You can call them to verify the authenticity of the calls you are receiving to stop their harassment. If they keep calling, then you should know that calls are a normal part of the debt collection process. It is when they begin to harass you that they may be guilty of debt collection harassment or be a fraudster trying to pull off one of many reported scams.

Why Are They Calling Me❓

They are most likely calling you because you owe money on a credit card debt. To stop the calls, send a cease-and-desist letter or hire a consumer rights attorney. Retaining the services of a qualified consumer rights attorney will also go a long way to help you.

Does this Bank sue? This is yet another question that may be on your mind. You should know that they reserve the right to take you to federal court over the non-payment of your debts. They are, however, required to notify you of their intent to take legal action in federal court against you.Comenity Capital Bank Columbus, Ohio, may be guilty of debt collection harassment.

If you are not sure of the name of the collection agency that is contacted, you then feel free to visit our List of Collection Agencies in the United States

Know Your Rights: Fair Debt Collection Practices

The FDCPA protects consumers from abusive debt collection, regulating debt collectors like Comenity Bank. Under the FDCPA, debt collectors are prohibited from engaging in abusive, unfair, or deceptive practices. This includes making false statements, using unfair collection tactics, and any form of harassment. For instance, debt collectors cannot threaten you with legal action that is not applicable or misrepresent the amount you owe.

Key Consumer Protections in Debt Collection

The FDCPA requires debt collectors to give you written notice of the debt, including the amount, creditor’s name, and your rights, including disputing the debt. Additionally, debt collectors are restricted from contacting you at inconvenient times or places. They cannot call you before 8 am or after 9 pm, and they are prohibited from contacting you at your workplace. If you request that a debt collector stop contacting you, they must comply.

Understanding your rights under the FDCPA can help you protect yourself from unfair and abusive debt collection practices. You can take action to stop the harassment and hold them accountable.

Signs of Debt Collection Harassment

Debt collection harassment can manifest in various ways, and recognizing the signs is the first step in protecting yourself. Common forms of harassment include repeated phone calls, threatening letters, and false statements about the debt.

Debt collectors may use high-pressure tactics to intimidate you into paying a debt. This can include making false threats of lawsuits or wage garnishment, which are intended to scare you into compliance. Additionally, some debt collectors may use abusive language or make harassing phone calls, creating a hostile and stressful environment.

If you are experiencing any of these signs of debt collection harassment, it is important to seek help. A consumer rights lawyer can assist you in understanding your consumer rights, under the FDCPA. They can provide legal advice and represent you in any disputes with the debt collector.

You may also consider filing a complaint with the Federal Trade Commission (FTC) or your state’s Attorney General’s office. These agencies can investigate consumer complaints about the debt collector’s practices and take action if they are found to be violating the law. Remember, you do not have to endure debt collection harassment. Knowing your rights and taking appropriate action can help you regain control and stop the abusive debt collection practices act.

💬Common Questions Asked about Comenity Bank Harassment

Q: What do I do if a debt collection organization is harassing me ❓

If the organization’s representative is rude, aggressive, or abusive. You can contact us to determine whether you have an actionable harassment case.

Q: How many calls must you receive from Comenity before it is to be considered harassment❓

A: There’s no set number. Comenity Bank harassment depends on the nature of the calls, not just the quantity.

Q: What if you are receiving harassing text messages❓

A: Sending aggressive or threatening text messages constitutes harassment. Save evidence of any harassing text messages you received.

A debt collector cannot do the following:

- ➡️ Make anonymous calls to you

- ➡️ Call you at odd hours of the day

- ➡️ Misinterpret the figure of your debt or interest

- ➡️ Call you repeatedly, especially after you have asked them to stop.

- ➡️ Threaten you with violence or jail time

- ➡️ Inform the third party about your debt

Q: How do I provide evidence regarding the legitimacy of my harassment claim❓

A: Gather all communications, dates, times, and witness accounts. An attorney can advise further. You should save any harassment calls you have received on your voicemail for future reference. You can find more information here.