If Comenity Bank or its debt collectors are calling you repeatedly from phone numbers like 208-719-3279, 720-728-3218 causing stress, trauma, or harassment, even if you owe money, you may be facing illegal debt collection practices. The FDCPA and TCPA protect consumers from these abuses.

Who is Comenity Bank?

Comenity Bank is one of the major credit card companies in the United States today. The company offers both credit and debit card services to over 93 retail stores across America using largely store-branded credit cards. With a clientele of over 150 retailers, this institution has been connecting consumers to their favorite retailers for over 30 years. Since the company has an in-house collection and billing department, Comenity Bank debt collection harassment and phone harassment have become very common among consumers who owe unsettled debts to the company.

Besides the horrors faced by many consumers dealing with Comenity Bank harassment and debt collection, there have also been several allegations of scams, financial crimes, and breaches of laws such as the TCPA by the agency.

- Bread Financial (Parent Company) Address: PO Box 182273, Columbus, Ohio 43218

Common Comenity Bank Store Credit Cards

Forever 21 Credit Card

Express Card

Zales Diamond Card

Ashley Stewart Card

Woman Within Credit Card

Torrid Card

Wayfair Card

Ulta Card

Total Rewards Card

Victoria’s Secret Card

What Counts as Comenity Bank Harassment

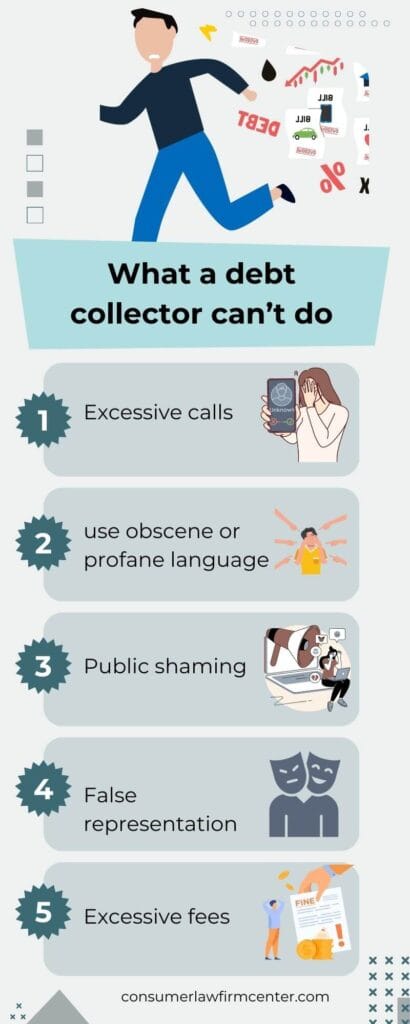

Debt collectors cannot do the following:

Visit your home or workplace without permission

Make false claims about your debt

Falsify documents or threaten arrest for unpaid debts

Charge excessive fees or interest

Call using bank numbers improperly for debt collection

Experiencing repeated or threatening calls from Comenity Bank? Call Consumer Rights Law Firm, PLLC at (877) 700-5790.

What Does Not Count as Harassment

Reasonable debt collection activities are legal:

Sending reminders about your debt

Calls you’ve consented to (like robocalls)

Discussing the debt status

Visiting at reasonable hours

Filing a legitimate lawsuit

Why Is Comenity Bank Calling Me?

They may contact you for:

Missed payments or delinquent accounts

Verification of account activity

Debt collection on store-branded cards

Unsure about the calls? Never share personal info until verified. Always contact official Comenity numbers.

What If I Have Already Settled My Debt?

The bank cannot contact you for debts that have been settled or discharged in bankruptcy. If the Comenity bank or collections are calling you with information about a debt that you do not owe or store credit card that you do not remember acquiring, here are a few things that you should do:

- Inform the caller that the alleged debt has been resolved or discharged into bankruptcy. Tell them that it may be a mix-up somewhere, and politely ask that they look into it.

- You are entitled to a debt validation letter; ask for it. They are required to send this letter to you within 5 days of their initial contact with you.

- Go through the records you have on your end to confirm if the debt actually exists, how much it is, and if it has already been resolved or settled. Examples of records to review involve old account statements and copies of canceled checks. Be sure to keep them handy as well because you may need them in court.

- Check your records with the credit bureaus. If the debt exists, it was probably reported to the credit bureaus.

How to Stop Comenity Bank Calls

Send a Cease-and-Desist Letter

Include your name, address, the collector’s name, and a request to stop contacting you

Send via certified mail with return receiptRequest Communication Only in Writing

Under FDCPA, they must comply

With the CFPB or your state Attorney General.

Also Watch for Comenity Bank Harassment Other Phone Numbers

Primary Numbers

614-729-6090, 303-255-5349, 303-255-5352, 303-255-5354, 614-212-5293, 913-563-5511, 720-456-3687, 913-563-5510, 614-729-6087, 614-729-5609, 614-754-4136, 800-695-2912, 614-534-2516, 800-251-1344, 913-312-9496, 901-881-9965, 650-200-1467, 866-326-0809, 202-417-2116, 360-868-6188, 303-255-5348

Repeated / Common Contact Numbers

800-695-2912, 614-534-2516, 614-212-7500, 720-728-3217, 844-271-2816, 614-729-6086, 614-754-4132, 614-754-4056, 614-534-2515

Additional Repeated Contacts

877-475-3483, 913-577-5000, 614-729-6091, 614-754-4060, 801-438-8376, 208-719-3271, 303-255-5054, 614-729-7086, 614-212-5292, 888-393-7162, 303-209-2049, 614-729-9031, 855-497-8174

Other Combinations / Repeats

614-754-4137, 614-729-3989, 720-456-3679, 720-456-3744, 720-456-3742, 720-456-3741, 720-456-3740, 720-456-3711, 720-456-3682, 855-497-8173, 614-212-7532, 612-212-7530

Frequently Used Contact Lines

913-312-3216, 913-312-9502, 614-212-5291, 614-729-9037, 800-675-5685, 855-796-9632, 888-332-4728, 888-819-1918, 800-695-1788, 886-925-7109, 800-772-1413, 855-506-2496, 844-271-2552, 800-821-5744

Miscellaneous / Regional Numbers

720-356-3688, 732-806-3199, 609-400-7010, 614-729-9025, 913-312-9488, 800-305-1215, 855-334-4198, 614-729-4000, 614-729-7670, 614-729-6040, 913-563-5522, 303-255-5045, 800-695-9478, 800-220-1181, 800-854-6755, 800-869-3557, 833-755-4354, 800-695-9583, 866-789-4961, 1866-427-428

Toll-Free / Customer Service Numbers

800-367-3647, 800-981-7490, 888-245-4064, 800-376-0581, 1-800-967-1398, 800-926-5393, 866-907-5594, 844-271-2757, 1-844-271-2758, 877-362-7264, 888-566-4353, 855-269-1622, 1-844-271-2535, 1-877-258-6953, 1-855-567-7738, 844-271-2778, 855-506-2496, 888-621-3809, 866-308-0681

Other Support / Helpline Numbers

855-617-8084, 855-603-5666, 855-567-7741, 866-832-8035, 800-995-9450, 800-395-3780, 1-866-254-9967, 888-774-8661, 855-463-6345, 800-695-5258, 866-258-0114, 866-828-7755, 866-891-3458, 1-866-843-0194

Additional Toll-Free Lines

800-387-9098, 855-408-1657, 855-266-0556, 614-729-3000, 844-271-2708, 866-507-6744, 866-810-3618, 800-201-4955, 800-767-1309, 866-512-6286, 866-284-2764, 866-283-6797, 888-252-5484, 855-497-8168, 866-353-2214, 866-285-1323

Extended Support / Helplines

866-327-4367, 866-534-4180, 866-869-9354, 866-322-1316, 866-832-8041, 866-482-4479, 844-271-2559, 855-567-7743, 855-842-9240, 888-724-6649, 866-327-4425, 855-408-1662, 888-428-8810, 888-866-8932, 855-334-3649, 800-329-9713, 888-245-4124, 800-695-0466, 844-271-2522

Additional Lines

800-888-4163, 855-506-2496, 844-271-2688, 888-427-7785, 800-474-7552, 866-884-9859, 1-866-907-5612, 877-756-1958, 866-308-0680, 347-374-1555, 614-754-4073, 720-456-3687, 855-437-5016, 913-312-3217

Final Set of Regional / Miscellaneous Numbers

886-925-7109, 855-408-1658, 844-271-2794, 844-271-2653, 800-695-8045, 855-334-3686, 855-334-3613, 866-303-5087, 888-275-2480, 866-888-1569, 800-889-0494, 800-362-8430, 855-497-8157, 1-800-695-1219, 800-304-8710, 877-851-3123

Remaining Support / Helplines

800-367-9284, 800-723-4548, 800-252-1849, 844-271-2718, 800-767-3662, 866-234-2029, 800-217-8071, 866-807-9835, 800-695-0195, 866-283-1065, 866-522-8014, 800-927-3783, 844-271-2543, 877-206-7862, 888-724-6649, 877-287-8879

Final Long-Tail / Misc Numbers

866-271-2409, 888-252-5557, 800-324-0324, 866-230-7070, 866-234-2038, 844-271-2678, 800-367-9284, 800-723-4548, 888-621-3813, 800-315-7260, 800-853-2921, 866-322-1316, 855-381-5715, 866-662-6199, 855-835-8414, 844-271-2665, 866-392-5825, 888-428-8818, 866-279-1485, 855-839-2900, 800-695-9478

Large Misc / Regional / Office Numbers

844-271-2567, 800-695-3988, 844-271-2823, 888-621-3815, 866-776-9859, 866-254-9971, 855-567-7745, 844-271-2708, 877-622-5314, 720-456-3695, 614-729-9026, 614-729-9043, 913-677-8365, 614-534-2520, 208-719-3274, 303-323-8692, 505-253-0592

Final Regional / Office Numbers

614-729-9041, 513-707-6993, 801-438-8379, 720-456-3768, 800-695-0019, 614-534-5420, 614-534-2547, 877-475-3483, 888-865-0828, 614-754-4060, 720-456-3745, 855-957-3119, 913-677-8323, 913-677-8324, 614-729-6088, 303-255-5109, 720-728-3218

Final Short / Misc Office Lines

614-212-7504, 614-754-4074, 913-312-0548, 614-212-5166, 614-212-7056, 913-312-5098, 913-563-5523, 913-563-5507, 614-729-5385, 208-719-3279, 614-729-9021, 913-312-0990

Keep in Mind!

Does this Bank sue? This is yet another question that may be on your mind. You should know that they reserve the right to take you to federal court over the non-payment of your debts. They are, however, required to notify you of their intent to take legal action in federal court against you. Comenity Capital Bank Columbus, Ohio, may be guilty of debt collection harassment.

If you are not sure of the name of the collection agency that is contacted, you then feel free to visit our List of Collection Agencies in the United States

Get Consumer Law Firm, PPL to Help

Consumer Rights Law Firm, PLLC is a law firm that specializes in helping clients who are facing Phone Harassment in any form, including telephone communication. Rather than suffer alone, contact our office to begin the process to stop Credit Corp Solutions Phone Harassment. Our office has been assisting consumers since 2010. We have an A+ rating with the Better Business Bureau.

If you are interested in learning more about how to safeguard yourself and prevent phone harassment, call us at (877) 700-5790 for immediate assistance or visit our website.

FAQs

How to stop Comenity bank calls?

You can stop Comenity Bank collection calls by sending a written cease-and-desist letter or by requesting communication only in writing under the FDCPA (Fair Debt Collection Practices Act). If the calls are excessive or harassing, you may file a complaint with the CFPB or contact a consumer rights attorney.

Does Comenity bank call you?

Yes, Comenity Bank or their debt collection partners may call you if you have late payments or a delinquent account. However, they must follow federal debt collection laws—meaning no harassment, threats, or odd-hour calls are allowed.

Why would Comenity bank call me?

Comenity Bank usually calls about missed credit card payments, verification of account activity, or debt collection. If you’re unsure, don’t share personal info on the phone—always verify the call by contacting Comenity Bank directly.

What’s Comenity bank debt collection phone number?

Comenity Bank uses multiple numbers, but their official customer service line is 1-855-842-9245. If you get a call from an unfamiliar number claiming to be Comenity, verify it by calling this official number first.

Comenity bank calling from an unknown number: what to do?

If Comenity Bank calls you from a hidden or unknown number, don’t answer immediately. Instead, let it go to voicemail and then verify by calling Comenity’s official number. Scammers often spoof caller IDs pretending to be banks.

What’s Comenity bank ashley stewart customer service number?

The official Comenity Bank Ashley Stewart credit card customer service number is 1-800-376-0581. Call this number for account inquiries, payments, or disputes.

Why Comenity bank calling family members?

If Comenity Bank is calling your relatives, it may be because they are trying to locate you. Under law, they cannot discuss your debt with family—only confirm your contact details. If they reveal details, that may be a violation of your rights.

Whats Comenity bank phone number live person usa?

To speak directly with a live representative in the U.S., call 1-855-842-9245 and follow the prompts. Press “0” or say “representative” if you’re stuck in the automated system.

Will Comenity bank sue me?

Comenity Bank can sue for unpaid debts, but lawsuits are usually a last resort. Before that, they’ll attempt multiple calls, letters, and settlement offers. If you’re sued, respond quickly to avoid a default judgment.

How to get rid of Comenity bank scams text message?

If you receive suspicious Comenity Bank text messages, don’t click links or share personal data. Forward the scam text to 7726 (SPAM), block the sender, and contact Comenity directly at their verified number.