Answering Your Most Urgent Questions About Debt Collector Harassment

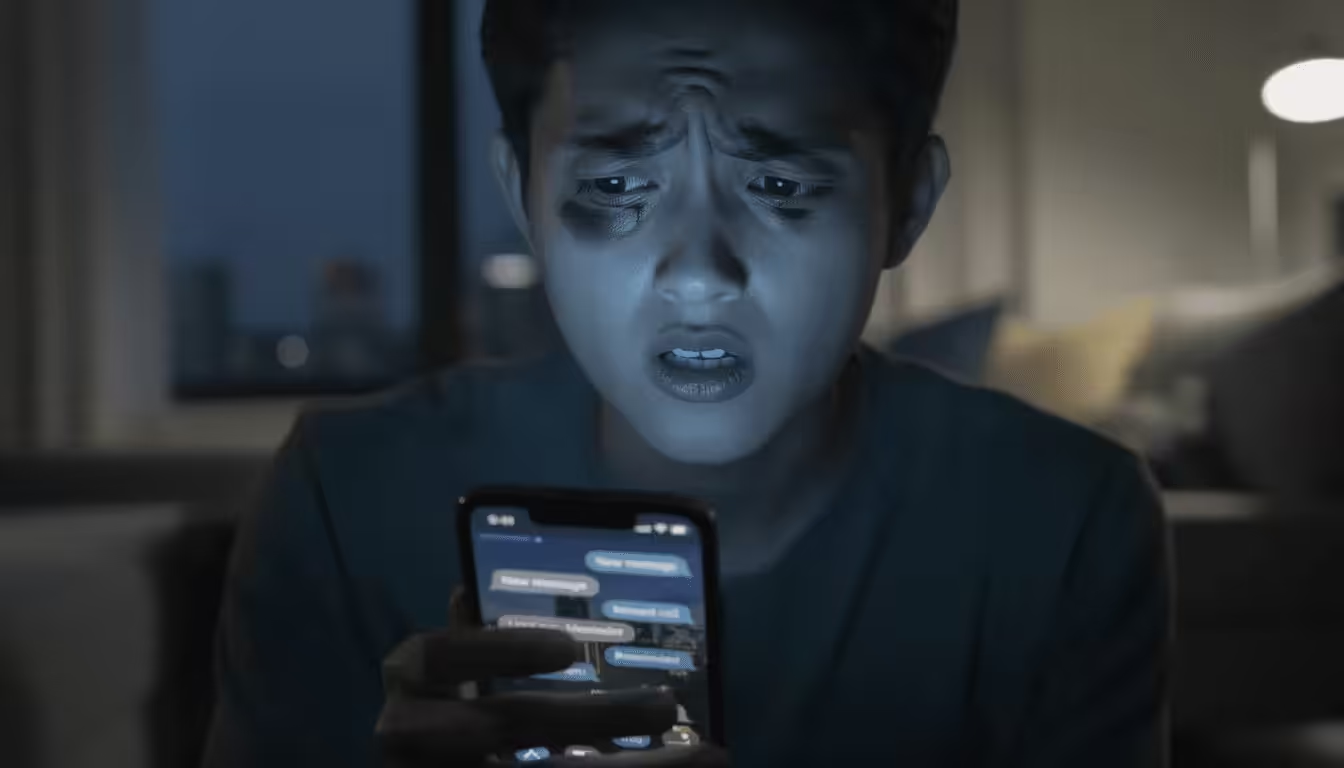

If your phone buzzes and your heart races, you’re not imagining things. Constant calls, texts, and threats from debt collectors can cause real anxiety, sleep loss, and panic attacks that disrupt every part of your life. The good news: U.S. law strictly limits what collectors can do to you—specifically the Fair Debt Collection Practices Act (FDCPA, 15 U.S.C. §§ 1692–1692p) and updated CFPB rules effective November 30, 2021.

Here’s what you need to know right now:

- You generally cannot be arrested or jailed for consumer debt in the U.S. in 2025—threats of criminal prosecution for unpaid credit card debt or medical bills are almost always illegal scare tactics

- Collectors usually can’t call before 8 a.m. or after 9 p.m. local time

- They cannot threaten violence, use obscene language, or repeatedly call you to annoy you

- You can tell them to stop contacting you in writing, and they must comply (with limited exceptions)

- You can recover money damages for illegal harassment

The emotional distress you’re feeling is real, medically recognized, and not a sign of weakness. Mental health tools and legal protections together can help you regain control.

How Debt Collection Harassment Affects Your Mental Health

Congress explicitly recognized in 1977 when passing the debt collection practices act that abusive collection practices cause “marital instability, loss of jobs, and invasions of individual privacy.” Modern research confirms what you may already feel: sustained harassment from a collection agency is linked to anxiety, depression, and even thoughts of hopelessness.

Common Emotional Effects

- Constant dread when the phone rings—you may start avoiding calls from any unknown number

- Intrusive thoughts about bills that interrupt work, meals, and time with family

- Irritability and conflict with partners, children, or roommates who don’t fully understand what you’re going through

Clinical Mental Health Impacts

- Increased risk of generalized anxiety disorder, depression, and panic attacks

- Sleep disturbance and nightmares about being sued, arrested, or having wages garnished

- Physical symptoms like headaches, chest tightness, nausea, and stomach issues

Social and Work Impacts

- Avoiding friends and family gatherings because of embarrassment about your financial situation

- Fear that collectors will call at work or talk to a supervisor, leading to constant hypervigilance

- Reduced concentration and performance at work or school, which can worsen your financial strain

A real-world example: Imagine a single parent in 2023 dealing with medical bills from a child’s emergency room visit. The calls start at 8:01 a.m. daily, right as they’re getting kids ready for school. The voicemails are vague but ominous: “Call us immediately about a serious legal matter.” Within weeks, they’re experiencing panic attacks before breakfast, snapping at their children, and unable to focus at work. The shame, panic, and hopelessness feel overwhelming.

This isn’t weakness. This is a normal human response to sustained psychological pressure.

Recognizing Illegal Debt Collector Harassment

If you’re jumping every time your phone buzzes, it helps to know exactly what crosses the legal line. The FDCPA § 806 (15 U.S.C. § 1692d) and CFPB Regulation F (12 C.F.R. § 1006.14, effective November 30, 2021) define specific prohibited conduct whose natural consequence is to harass, oppress, or abuse.

Harassment by Phone

- Repeated or continuous telephone calls intended to annoy, abuse, or harass

- CFPB’s call-frequency guideline: More than 7 calls in a seven day period about a particular debt, or any call within 7 days of a live telephone conversation, is presumed harassment unless you gave prior consent

- Calls at unusual hours—before 8 a.m. or after 9 p.m. local time—without your agreement

Verbal Abuse and Threats

- Use of obscene or profane language (even a single instance can violate the law)

- Threats of violence or harm to you, your family, or your property

- False threats of arrest, jail, immigration action, or property seizure when those steps aren’t legally allowed or not actually intended

Lies and Misleading Representations

Under FDCPA § 807, collectors cannot make false statements or misleading representations:

- Pretending to be from a government agency, sheriff’s office, court, or the IRS

- Claiming a lawsuit, wage garnishment, or bank account levy is “already filed” when it is not

- Overstating the amount owed, adding unauthorized late fees, or claiming they can collect interest they’re not entitled to

Red Flags Checklist

Compare your experience against these warning signs:

| Red Flag | What It Might Mean |

|---|---|

| 3+ calls in one day about the same debt | Likely excessive under CFPB rules |

| Caller threatens to “send the police by Friday” | Illegal threat of criminal means for civil debt |

| Voicemail uses profane language | Clear FDCPA violation |

| Collector claims to be an attorney when they’re not | False representation |

| Says you’ll lose your home tomorrow without a court order | Misleading representation about legal action |

Harassment by Phone: When Collectors Cross the Line

The ringing never seems to stop. Calls that begin right at 8:00 a.m. and continue until 9:00 p.m. can disrupt your sleep, your work, and your ability to function. Understanding the specific rules can help you identify when a debt collector communicates in ways that violate the law.

Time and Place Limits

Under FDCPA § 805(a)(1), 15 U.S.C. § 1692c(a)(1):

- Collectors cannot call at times known to be inconvenient—typically before 8 a.m. or after 9 p.m. local time

- If the collector knows your work schedule (for example, you’re a night shift nurse), what counts as a “reasonable time” may differ

- Calling at unusual hours without your prior consent is a violation

The Repeated Calls Rule

CFPB Regulation F (12 C.F.R. § 1006.14(b)) established clear limits in 2021:

- 7 calls in 7 days per debt creates a presumption of harassment

- After a live telephone conversation, there’s a 7-day cooling-off period before they can call again about that such debt

- Even if individual calls seem compliant, the cumulative effect of other conduct can constitute harassment

Voicemail and Missed-Call Anxiety

“Ringless voicemail” technology allows collectors to leave messages without your phone actually ringing—but these still count as communications under the law limits. Multiple missed calls with vague messages like “call us immediately about a serious matter” are designed to create fear.

What to do: Keep a simple call log with the date, time, called number or caller’s identity, and brief notes about what was said. This documentation supports both mental health treatment (showing your therapist the pattern of stressors) and potential legal claims.

Harassment by E-mail, Text, and Social Media

Since November 30, 2021, federal rules (Regulation F, 12 C.F.R. § 1006.22 and § 1006.18) explicitly address e-mail, text, and social media messaging by debt collectors. These digital channels can make harassment feel inescapable—following you into bed, onto your phone, and into spaces meant for family and friends.

E-mail and Text Limits

- While collectors can generally use these channels, messages cannot be misleading, abusive, or excessively frequent

- Consumers can revoke consent or opt out of specific channels

- A debt collector sends a private message, they must include meaningful disclosure of their identity and the debt

Social Media Rules

The law is clear about social media:

- No public posts or tags about your debt—a collector cannot post on your Facebook timeline or tag you in a way others can see (12 C.F.R. § 1006.22(f))

- Only private messages are permitted, and the collector must clearly disclose they’re a debt collector

- Allegedly refuse to pay your debts owed? They still can’t shame you publicly

Psychological Impact

- Waking to early-morning texts or seeing collection messages mixed with family photos and work chats heightens stress and shame

- Threatening messages at night can trigger sleeplessness and rumination

- The invasion of personal digital spaces feels like there’s nowhere safe

Protect Yourself

- Screenshot abusive or misleading messages with timestamps and usernames

- Avoid engaging in late-night arguments with collectors online

- Consider blocking or filtering after asserting your rights in a written notice

Example of improper conduct: A collector posting “John Doe doesn’t pay his bills” in a public comment thread violates federal law and your privacy.

Harassment at Work and Impact on Job Security

Workplace calls are uniquely stressful because they threaten both your income and your reputation. The fear of being “found out” by coworkers or supervisors can compound anxiety and trigger panic attacks during work hours.

Workplace Contact Rules

Under FDCPA § 805(a)(3):

- A collector cannot contact you at work if they know your employer disallows such calls

- Simply telling them “my employer doesn’t allow these calls” triggers this protection

- 12 C.F.R. § 1006.6 limits use of work e-mail, particularly employer-controlled accounts where HR or IT can read messages

Examples of Improper Workplace Contact

- Calling a receptionist repeatedly and asking to be transferred to you

- Leaving detailed voicemails on a shared office phone where coworkers might hear

- Sending messages to your employer-provided e-mail about debts owed

Psychological and Career Consequences

- Fear of disciplinary action or firing if supervisors learn about debt issues

- Humiliation when coworkers overhear calls or see you scrambling to take them privately

- Distraction leading to mistakes, poor performance reviews, and worsening financial strain

Steps to Stop Workplace Contact

- Tell the collector clearly: “My employer prohibits personal calls at work. Do not contact me here.”

- Follow up with a written letter or e-mail confirming no further communication at your workplace

- Document any continued contact—dates, times, what was said—for potential FDCPA claims

The chronic worry about being “exposed” as someone who allegedly refuse to pay debts creates constant hypervigilance every time your desk phone rings.

Harassment Involving Friends, Family, and Your Reputation

Many people’s worst fear is that collectors will contact a spouse, parents, adult children, or neighbors. This invasion triggers profound shame and social anxiety that can damage relationships for years.

Third-Party Contact Limits

Under FDCPA § 804 and § 805:

- Collectors may generally contact others only for acquiring location information—your telephone number or mailing address

- They cannot mention the debt itself or the amount to third parties

- They can only discuss your debt directly with you, your spouse, your attorney, only the creditor, or a consumer reporting agency

Examples of Improper Third-Party Communications

- Telling your parent or adult child that you “refuse to pay your credit card debt”

- Leaving messages about what the consumer owes with a neighbor or roommate

- Posting anything about your debt in a public community forum or group chat

Emotional Fallout

- Feelings of humiliation and damaged relationships with family members

- Reluctance to attend family gatherings where someone might mention “the call they got”

- Increased isolation and avoidance of social situations

- Anxiety about answering calls in front of others

What to Do

- Ask friends or family to write down all details of any collector contact (date, time, what was said, caller’s identity)

- Send the collector a written dispute and “no third-party contact” letter

- Consider speaking with a consumer protection attorney if reputation damage is significant

The legal protections exist precisely because invasion of privacy and erosion of trust within close relationships cause real psychological harm.

Your Legal Rights: Federal Protections Against Harassment

The FDCPA was enacted in 1977 specifically because Congress found that abusive debt collection practices contribute to personal bankruptcies, marital instability, and invasions of privacy. The law was updated by the Dodd-Frank Act in 2010 (Public Law 111-203, Title X) and CFPB rules in 2020-2021—all intended to reduce emotional and financial harm.

Core FDCPA Protections

| Section | Citation | What It Prohibits |

|---|---|---|

| § 805 | 15 U.S.C. § 1692c | Limits on who collectors can talk to and when they can contact you |

| § 806 | 15 U.S.C. § 1692d | Ban on harassment or abuse (threats, profane language, repeated calls) |

| § 807 | 15 U.S.C. § 1692e | Ban on false, deceptive, or misleading statements |

| § 808 | 15 U.S.C. § 1692f | Ban on unfair practices (collecting unauthorized amounts, threatening seizure) |

Communication Rules

- Collectors cannot contact you at unusual hours or known inconvenient times and places

- They must stop contacting you at work if they know your employer objects

- They must identify themselves as debt collectors in most communications

Validation and Transparency (FDCPA § 809)

Within five days of first contact, collectors must send a written notice including:

- The amount of the such debt

- The name of the original creditor or financial institution

- Your right to dispute within 30 days

- Information about how to request validation

If a consumer requests validation in writing within 30 days, collection efforts must pause until verification is provided.

Important: These rights apply primarily to a third party debt collector (agencies, collection law firms) rather than the original creditor. However, some state laws extend similar protections to original creditors.

State Laws and Extra Protections (With an Eye on Mental Health)

The FDCPA sets a national baseline, but many states add extra protections that can further reduce harassment and stress. Understanding your state’s specific debt collection practices can provide additional peace of mind.

State-Specific Examples

Texas:

- Texas Finance Code Chapter 392 mirrors and expands federal protections

- Texas Constitution Article I, § 18 prohibits imprisonment for debt

- Threats of arrest for consumer debt violate state law

Maryland:

- Consumer Debt Collection Act requires licensing for collectors

- Judgments obtained by unlicensed agencies can be voided

- Additional restrictions on harassing conduct

California and New York:

- Stronger privacy protections about who can be told about your debts

- Additional limits on wage garnishment that reduce catastrophic anxiety about losing income

Psychological Benefits of State Protections

- State laws may limit wage garnishment or property seizure, reducing fear about losing a home

- Shorter statutes of limitations in some states mean less long-term anxiety about being sued over old debts

- Stronger privacy rules protect against the social shame of exposure

Finding Your State’s Rules

- Visit your state attorney general’s website and search for “debt collection” resources

- Contact a local legal aid office or consumer rights clinic familiar with your state’s specific laws

- Remember that stronger legal rights often translate to reduced fear and better mental health outcomes

How to Tell Collectors to Stop: Cease Contact and Setting Boundaries

Setting boundaries isn’t just a legal act—it’s a mental health tool. Reducing triggers like constant calls and threatening texts can lower anxiety and give you space to think clearly about managing debt.

Your Cease-Contact Rights

Under FDCPA § 805(c):

- You can send a written letter telling a third-party debt collector to stop contacting you

- After receiving it, they can only contact you to confirm they will stop or to notify you of specific legal action (like filing a lawsuit in state or federal court)

- This applies to phone calls, texts, e-mails, and other communication methods

What Your Letter Should Include

- Your name and mailing address

- Account or reference number (if you have it)

- A clear statement: “I request that you cease all further communication with me about this debt under the Fair Debt Collection Practices Act”

- Date and your signature

How to Send It

- Use certified mail with return receipt requested (if affordable) for proof of delivery

- Keep a copy of the letter and postal receipts in a safe place

- Note the date you mailed it in your records

Pros and Cons

| Pros | Cons |

|---|---|

| Fewer calls and messages immediately | The collector may decide to sue instead of continuing informal collection |

| Reduced day-to-day emotional stress | Doesn’t eliminate the underlying debt |

| Creates documentation of your actions | May increase short-term anxiety about potential lawsuit |

Consider speaking with a nonprofit credit counselor or legal aid lawyer before sending a cease-contact letter, especially if you’re extremely anxious about being sued or want to explore a payment plan.

Documenting Harassment: Protecting Your Case and Your Well-Being

Documenting harassment serves two crucial purposes: it helps mental health professionals see a clear pattern of stressors, and it preserves evidence if you decide to file complaints or sue for actual damages.

What to Record

For each contact, note:

- Date and time of each call, text, e-mail, or social media message

- The telephone number, e-mail address, or account name used

- Brief notes on what was said, especially threats, obscene language, or false statements

- The caller’s identity if they provided it (or if they failed to identify themselves)

Preserving Written Evidence

- Save voicemails if your phone allows it

- Keep letters and envelopes (postmarks can prove dates)

- Take screenshots of texts, e-mails, and private social media messages (including timestamps)

- Print or save electronic records in multiple locations

Recording Phone Calls

Call-recording laws differ by state:

- One-party consent states: You can record without telling the collector

- All-party consent states: You must inform them the call is being recorded

Check your state law or speak with a lawyer before recording a telephone conversation. When in doubt, simply take detailed notes during the call.

Emotional Tracking

Keep a simple journal of how harassment affects your daily life:

- “Couldn’t sleep after 3 threatening calls on March 15, 2025”

- “Had panic attack at work after voicemail threatened wage garnishment”

- “Avoided family dinner because I was too ashamed to talk about the calls”

This journal supports claims for emotional distress damages and helps therapists plan treatment. Documentation is a way of regaining control.

When Debt Collectors Sue: Lawsuits, Garnishment, and Fear

The threat of being sued or having wages garnished is one of the biggest drivers of anxiety. But understanding that a lawsuit is a formal process with specific steps and defenses—not an instant emergency—can reduce panic.

Basic Lawsuit Process

- The collector files a complaint in federal court or state court

- You are served with legal papers and given a deadline (often 20-30 days) to respond

- Failing to respond can result in a default judgment

- Only after a judgment can the collector pursue garnishment in most states

Garnishment Basics

- In many states, collectors must obtain a court judgment before garnishing wages or seizing a bank account

- Federal benefits are heavily protected: Social Security, veterans’ benefits, SSI, and similar payments generally cannot be garnished for consumer debts

- Federal law limits wage garnishment to typically 25% of disposable earnings above a set threshold

- Some debts like child support, pay delinquent taxes, or federal student loans have different rules

Connecting This to Mental Health

- Fear of losing your entire paycheck can lead to catastrophic thinking and panic attacks

- Understanding actual legal limits—that collectors cannot take everything—can reduce some fear

- Knowing the process has steps gives you time to respond and seek help

What to Do If Sued

- Read the papers carefully and note the response deadline

- Contact a local legal aid office or consumer lawyer quickly

- Consider filing an answer even if unsure about defenses—this prevents default

- Never ignore court papers, even if the debt feels overwhelming

Remember: illegal threats (“we’ll have you arrested for this credit card debt”) are very different from legitimate legal action (a civil lawsuit). Knowledge lowers anxiety and supports better decision-making.

Old Debts, Time-Barred Claims, and Long-Term Anxiety

Fear about very old debts can linger for years, fueling chronic anxiety, even when those debts may be legally “time-barred”—meaning beyond the statute of limitations for lawsuits.

Time-Barred Debt Basics

- Each state has a statute of limitations (often 3-6 years, sometimes longer) for most consumer debts

- Once expired, collectors usually cannot successfully sue, though depending on state laws they may still ask you to pay debts

- Time limits vary by debt type: credit card debt, medical bills, personal loans, and others may have different limitations

“Resetting the Clock”

Be careful:

- In many states, making a payment or acknowledging the debt in writing can restart the statute of limitations

- Even a small “good faith” payment of a reasonable amount can reset the clock

- Know your state’s rules before paying or promising to pay on very old debts

Psychological Impact

- Surprise calls or letters about 10-year-old debts can suddenly revive shame and fear

- Understanding time-barred status can ease that fear and provide a sense of closure

- You may not owe money in the way the collector claims if the debt is very old

Protecting Yourself

- Ask for written validation of old debts before discussing payment

- Seek legal advice before agreeing to any payment plan on very old accounts

- Avoid making payments or written admissions until you know the legal consequences

Note: Time-barred debts can still appear on your credit report with a credit reporting company for up to seven years from delinquency. This can prolong financial stress even when you can’t legally be sued.

Protecting Your Mental Health While Dealing With Debt Collectors

This section focuses specifically on your emotional well-being. Legal boundary-setting and self-care work together to build resilience against sustained harassment.

Immediate Coping Strategies

- Let unknown numbers go to voicemail and return calls only at a calm time you choose

- Set “no debt talk” hours in the evening to protect your sleep

- Practice simple grounding or breathing exercises after stressful calls

- Remind yourself: the creditor intends to collect, but their tactics don’t define your worth

Professional Support

- Consider talking with a licensed therapist or counselor, especially if experiencing panic attacks, persistent insomnia, or thoughts of hopelessness

- Many community clinics, employee assistance programs, and online therapy platforms offer low-cost options

- CFPB data suggests that victim surveys show knowledge of rights reduces perceived threat and lowers anxiety significantly

Building a Support Network

- Share what’s happening with at least one trusted person—partner, friend, faith leader, or family member

- Reducing isolation and shame helps you think more clearly

- Avoid co-signing loans or sharing bank access impulsively out of panic

Practical Money Steps That Reduce Stress

- Contact a nonprofit credit counseling agency (such as those accredited by NFCC) to review options like debt management plans

- Create a simple, realistic budget that includes mental health needs—medication, therapy, stress-relief activities

- Remember that collection activities don’t have to consume your entire life

Small, realistic steps matter more than drastic life overhauls. Seeking mental health care is a rational response to sustained harassment—not a sign of weakness.

How to Report Abusive Collectors and Seek Legal Help

Reporting harassment is a form of empowerment that protects both you and others. The law allows you to recover money for emotional and financial harm—and taking action can provide real psychological relief.

Where to Report

| Agency | What They Handle |

|---|---|

| (CFPB) | Online complaint portal for individual violations; tracks patterns |

| State Attorney General | State-specific consumer protection enforcement |

| Federal Trade Commission | Patterns of unfair practices and industry-wide violations |

| Your state’s consumer protection office | Local resources and sample letters |

Suing for FDCPA Violations

Under FDCPA § 813 (15 U.S.C. § 1692k):

- You generally have one year from the date of the violation to file suit in state or federal court

- Possible recovery includes:

- Actual damages (lost wages, medical bills, therapy costs)

- Statutory damages up to $1,000 per case

- Attorney’s fees and court costs

- You may still owe the underlying debt even if the collector broke the law—but their violations give you leverage

Finding Legal Help

- Search LawHelp.org for free legal aid in your area

- Contact your state bar’s lawyer referral service for consumer law attorneys

- Many FDCPA lawyers offer free consultations and contingency fees (no upfront cost)

Emotional Closure

Taking formal action—even just submitting a complaint—can reduce feelings of helplessness. It validates your experience and shifts the power dynamic. You’re no longer just enduring; you’re responding.

The combination of mental health support, clear information about fair debt collection practices, and knowledge of your legal rights can significantly lessen the psychological toll of debt collector harassment.

Remember: You have rights. Debt collectors must follow the law. And while the stress of owing money is real, the harassment you’re experiencing may be illegal. Document everything, set boundaries, seek support, and consider reaching out to a consumer protection attorney or counseling professional who understands what you’re going through.

You don’t have to face this alone.