Bankruptcy Law Services | Consumer Rights Law Firm PLLC

Helping You Navigate Bankruptcy & Debt Relief

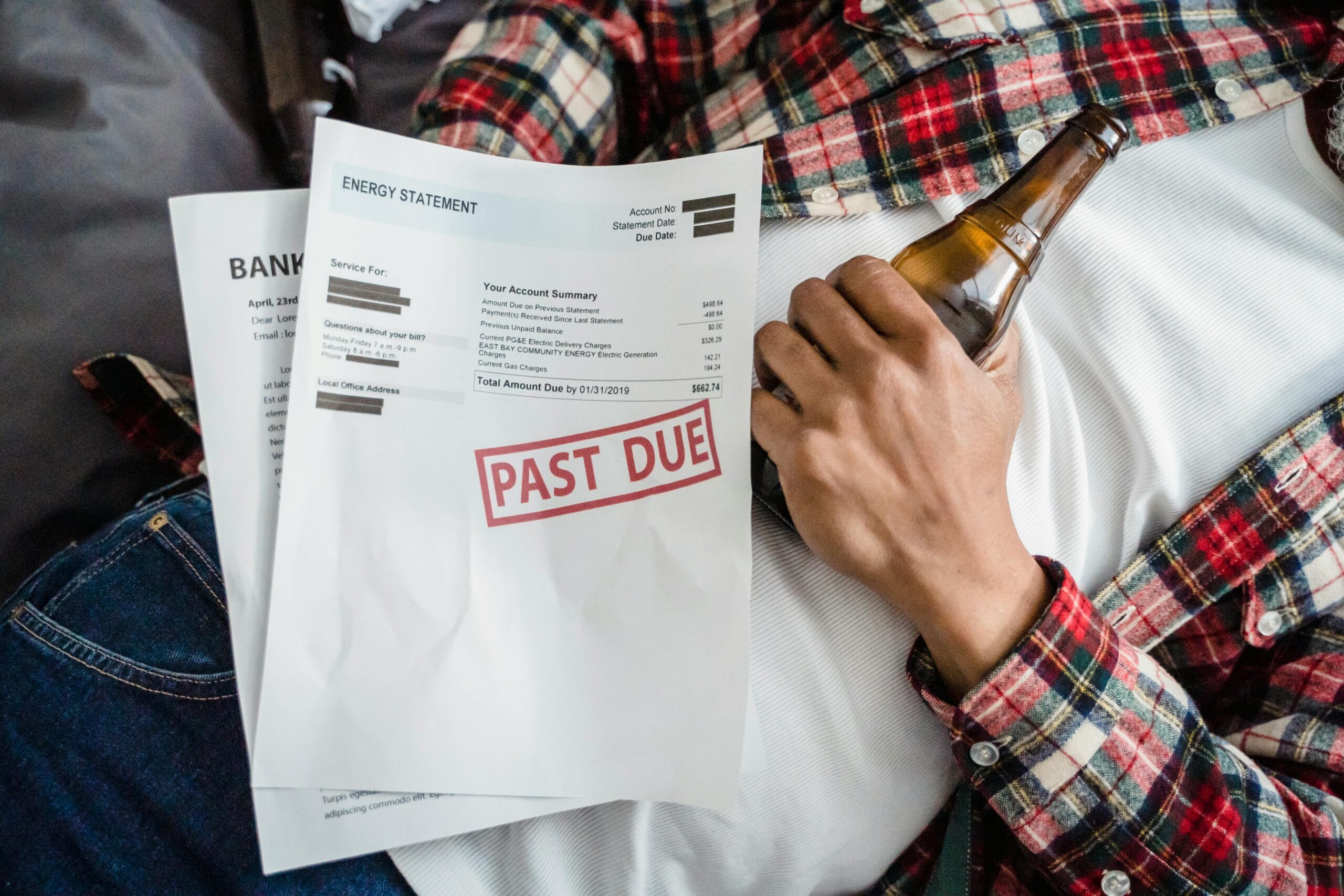

At Consumer Rights Law Firm PLLC, we understand that financial difficulties can be overwhelming. Whether you’re struggling with mounting debt, creditor harassment, or facing foreclosure, bankruptcy laws exist to provide you with a fresh start. Our experienced bankruptcy attorneys are here to help you explore your legal options and find the best solution for your financial future.

Types of Bankruptcy Cases We Handle

We provide comprehensive legal assistance in various types of bankruptcy filings and debt relief solutions, including:

Chapter 7 Bankruptcy – Liquidation Bankruptcy

- Ideal for individuals with overwhelming unsecured debt (credit cards, medical bills, personal loans).

- Most debts can be discharged, eliminating the legal obligation to repay them.

- Certain assets may be protected under state and federal exemptions.

- Typically completed in 3 to 6 months.

Chapter 13 Bankruptcy – Wage Earner’s Plan

- Designed for individuals with regular income who want to reorganize their debt.

- Allows for a structured repayment plan over 3 to 5 years.

- Prevents foreclosure, repossessions, and garnishments while allowing you to catch up on payments.

- May reduce or eliminate certain debts while protecting your assets.

Chapter 11 Bankruptcy – Business Reorganization

- Available for businesses and individuals with significant assets and debts.

- Allows businesses to continue operating while restructuring their financial obligations.

- Offers flexible repayment plans and potential reduction of outstanding debt.

- Used by corporations, partnerships, and high-debt individuals.

Chapter 12 Bankruptcy – Family Farmers & Fishermen

- Specifically designed for family-owned farms and fishing businesses.

- Allows for debt restructuring while continuing operations.

- Offers lower debt limits and specialized repayment plans.

Debt Settlement & Alternatives to Bankruptcy

If bankruptcy is not the best option, we can assist with debt settlement, negotiation, and restructuring outside of the court process. Our firm can:

- Negotiate with creditors to reduce total debt owed.

- Stop collection harassment and protect your rights under the Fair Debt Collection Practices Act (FDCPA).

- Explore options like loan modifications, forbearance agreements, and repayment plans.

Why Choose Consumer Rights Law Firm PLLC for Bankruptcy Assistance?

- Experienced Bankruptcy Attorneys – We have successfully helped individuals and businesses navigate bankruptcy proceedings.

- Personalized Debt Relief Solutions – We evaluate your financial situation and recommend the best strategy.

- Stop Creditor Harassment Immediately – Filing bankruptcy enforces an automatic stay, stopping collections, lawsuits, and wage garnishments.

- Protect Your Assets – We ensure that exemptions are maximized to protect your home, car, and personal belongings.

- Debt-Free Fresh Start – Our goal is to help you regain financial stability and move forward with confidence.

Take Control of Your Financial Future – Contact Us Today

If you’re struggling with overwhelming debt, let Consumer Rights Law Firm PLLC help you explore your legal options. Whether you need to file Chapter 7, Chapter 13, Chapter 11, or Chapter 12 bankruptcy, or are looking for alternatives, we are here to guide you every step of the way.

![]() Call us at877-700-5790

Call us at877-700-5790

![]() Chat with us in the lower right-hand corner of this page

Chat with us in the lower right-hand corner of this page

![]() Email us to schedule a free consultation

Email us to schedule a free consultation

Let us help you find relief from debt and achieve financial freedom with trusted legal representation.