Looking for clear guidance on New Jersey debt collection laws? New Jersey follows the Fair Debt Collection Practices Act (FDCPA), a federal law that protects you from abusive tactics. In this guide, we’ll walk you through your rights, what debt collectors can and cannot do, and how to take action if needed.

Key Takeaways

- New Jersey residents are primarily protected by the Fair Debt Collection Practices Act (FDCPA), which regulates debt collector behaviors to prevent harassment and abuse.

- Consumers have the right to file complaints against debt collectors for FDCPA violations and can pursue legal action for damages, including statutory damages of up to $1,000.

- New Jersey has a six-year statute of limitations for most consumer debts, after which creditors can no longer pursue legal collection, offering debtors significant protections.

Overview of Debt Collection Laws in New Jersey

New Jersey residents are primarily protected by the Fair Debt Collection Practices Act (FDCPA), the federal law that shields consumers from abusive debt collection practices. Unlike some states, New Jersey has not enacted its own additional debt collection laws, relying entirely on the provisions of the FDCPA to regulate the behavior of debt collectors.

The FDCPA sets clear boundaries on what debt collectors can and cannot do. It prohibits harassment, false statements, and unfair practices, ensuring that debt collection remains a fair and transparent process. In New Jersey, these federal protections are enforced by the New Jersey Division of Consumer Affairs, which oversees consumer protection laws and regulates business practices related to debt collection.

Navigating debt collection issues in New Jersey means understanding that while the state lacks its own specific laws, the robust federal protections under the FDCPA are fully in place. This foundational knowledge sets the stage for more detailed insights into your rights and the actions you can take when dealing with debt collectors.

Your Rights Under Federal Law (FDCPA)

The Fair Debt Collection Practices Act (FDCPA) is your primary shield against improper debt collection tactics in New Jersey. This federal law is designed to prevent debt collectors from engaging in harassed, deceit, or abuse during the debt collection process. For instance, debt collectors cannot threaten physical violence, use obscene language, or share your debt information with third parties.

Under the FDCPA, if a debt collector violates these protections, you have the right to file a complaint or even sue for damages. The (CFPB) enforces the FDCPA and offers a platform for consumers to report unfair financial practices. If successful in a lawsuit, you could receive actual damages and up to $1,000 in statutory damages.

Additionally, if you have legal representation, debt collectors are required to communicate with your attorney rather than directly with you. This ensures that your interactions with debt collectors are managed professionally and within the bounds of the law. Knowing these rights can help you feel more secure and prepared when dealing with debt collection issues.

Filing a Complaint Against a Debt Collector

If you believe a debt collector has crossed the line, filing a complaint is a crucial step. Complaints can be submitted online to both the New Jersey Division of Consumer Affairs and the CFPB. The Division of Consumer Affairs provides a general consumer complaint form that can be used to report issues with businesses, including debt collectors.

When filing a complaint, it’s essential to avoid including sensitive personal information. The Division of Consumer Affairs investigates complaints related to misleading business practices, ensuring that your concerns are taken seriously. Reporting a debt collector’s unlawful actions helps enforce the FDCPA and safeguards other consumers from similar abuse.

You can simultaneously file complaints with both state and federal agencies, enhancing the chances of a thorough investigation and appropriate action in accordance with your rights. This dual approach ensures that your complaint receives the notice it deserves and that any violations of your rights are addressed promptly, leaving you satisfied.

Legal Actions You Can Take Against Debt Collectors

When a debt collector violates your rights, taking legal action may be necessary. You have the option to sue a debt collector for damages if they breach the FDCPA. Winning such a lawsuit can provide compensation for actual damages and up to $1,000 in statutory damages.

For smaller cases, New Jersey’s small claims court provides a more accessible option for lawsuits involving debts of $5,000 or less. This allows you to seek justice without the complexities and costs associated with larger court cases.

Understanding these legal avenues can empower you to read up on unfair debt collection practices.

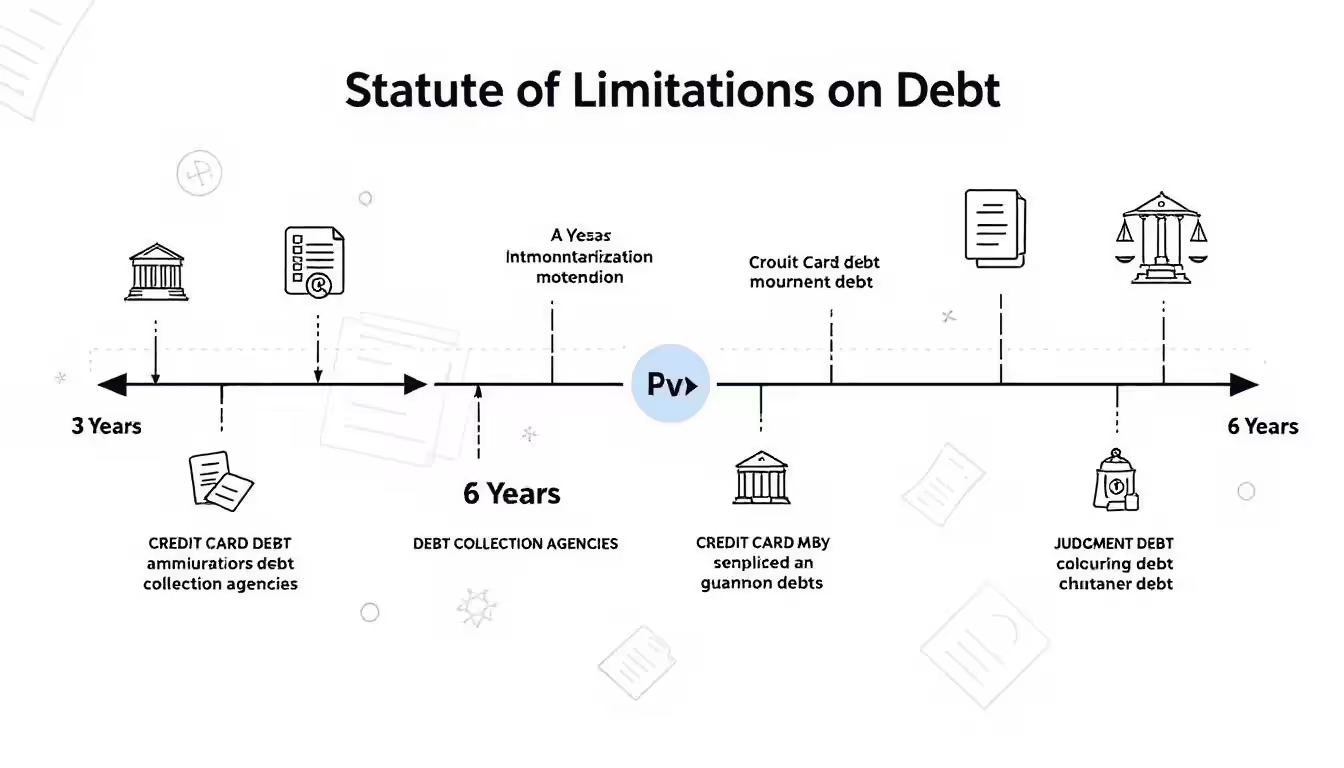

Statute of Limitations on Debt in New Jersey

In New Jersey, the statute of limitations for most consumer debts, such as credit card debts, is six years. This means creditors have six years to file a lawsuit to collect the debt. However, it’s important to note that this clock can be reset if you make a payment, acknowledge the debt, or set up new payment arrangements.

Once the statute of limitations has passed, creditors lose their legal right to pursue debt collection. Debtors are then protected from coercive collection tactics. This knowledge can provide peace of mind, knowing that after a certain period, you are no longer legally obligated to repay the debt, and that the matter ends there.

However, judgments in New Jersey have a much longer statute of limitations of 20 years, which can significantly extend the time collection period.

Types of Debt Covered by the Statute of Limitations

New Jersey’s statute of limitations applies to various type of debt, including other types of written contracts: financial obligations documented in formal agreements, such as contracts and loan documents. – Oral agreements: informal agreements made verbally, which must be validated with additional evidence. – Promissory notes. – Open accounts.

Promissory debt refers to clear promises to repay borrowed amounts, typically detailed in written notes with specific repayment terms. Open debt is characterized by flexible repayment arrangements that do not adhere to a fixed schedule. Understanding these categories helps clarify which debts are covered and how the statute of limitations applies uniformly to all forms.

What Debt Collectors Can Legally Do in New Jersey

Debt collectors in New Jersey are permitted to initiate contact through phone calls or other communication methods. If initial contact does not resolve the debt, collectors often proceed to legal action by suing the debtor.

In cases where legal action is taken, collectors can:

- Obtain court orders for wage garnishment, allowing them to withdraw funds directly from a debtor’s paycheck.

- Seek court orders to withdraw money from bank accounts if wage garnishment isn’t feasible.

- Place liens on real estate.

Federal regulations limit garnishment to the lesser of 25% of disposable earnings or disposable income minus 30 times the federal minimum wage. Knowing these legal boundaries can help you understand what debt collectors can and cannot do.

Exemptions and Protections for Debtors

New Jersey law provides specific protections for debtors. For instance, a portion of wages, specifically $48, is protected from garnishment, ensuring that debtors can retain essential income. Additionally, wage garnishment is limited to a maximum of 10% of a debtor’s income unless their earnings exceed 250% of the poverty level.

Debtors can also file objections to wage garnishments by submitting specific paperwork to the court. This legal recourse allows debtors to claim exemptions and protect a portion of their income. Understanding these protections can help you navigate the debt collection process more confidently and ensure that your essential financial needs are met.

Responding to Court Summons and Judgments

Receiving a court summons can be daunting, but the most important action is to respond. Failing to respond may result in a default judgment against you, granting the creditor the right to pursue wage garnishment or other collection methods. Responding to the summons is crucial to avoid giving the collector an easy win.

If you have a valid reason for not responding initially, you can challenge a default judgment by filing a motion to vacate the judgment. After responding, the court will notify you of a trial date, and failing to attend could lead to losing your case. Judgments have a much longer statute of limitations, specifically set at 20 years.

When responding to a summons, you may need to provide affirmative defenses that explain why you believe you do not owe the debt. In such cases, seeking legal help can be highly beneficial, as a lawyer can guide you through the process and help strategize a defense. Understanding these steps can make dealing with court summons and judgments less intimidating.

Options for Debt Relief in New Jersey

For those overwhelmed by debt, New Jersey offers several options for debt relief. Bankruptcy, for instance, can halt wage garnishment and provide immediate relief from collection efforts. Before filing for bankruptcy, individuals must obtain credit counseling from an approved provider.

There are also state-licensed debt adjustment services available to help manage debt related issues. Financial counseling organizations can assist with debt issues, including foreclosure, and debt management plans can help consolidate payments and lower interest rates. These options provide practical ways to manage debt and work toward financial stability:

- State-licensed debt adjustment services

- Financial counseling organizations (including assistance with foreclosure)

- Debt management plans (to consolidate payments and lower interest rates)

When to Seek Legal Help

If you are being sued over a debt in New Jersey, contacting a lawyer is critical. A lawyer can help you reviewing your case details, understand your rights, and strategize a defense. Legal advice can be invaluable in navigating the complexities of debt collection cases.

Lawyers can guide you through the litigation process and represent your clients’ interests in court. Consultations with local consumer rights attorneys can provide the legal advice needed to access informed people and proceed with confidence. Knowing when to seek legal help can significantly impact the outcome of your property case and ensure your rights are protected.

Summary

Navigating debt collection in New Jersey involves understanding your rights under federal law, knowing how to file complaints, and exploring legal actions against debt collectors. The statute of limitations and the types of debt it covers can impact how you manage debt collection issues.

By being informed about what debt collectors can legally do, the protections available to debtors, and the options for debt relief, you can take control of your financial situation. Seeking legal help when necessary can provide additional support and ensure your rights are upheld. Empower yourself with knowledge and take proactive steps to manage your debt effectively.

Frequently Asked Questions

What are my rights under the FDCPA?** **?

You have the right to be free from harassment, deception, or unfair practices by debt collectors under the FDCPA. This includes protections against the use of obscene language, threats, and unauthorized disclosure of your debt information.

How can I file a complaint against a debt collector in New Jersey?** **?

You can file a complaint against a debt collector in New Jersey by submitting an online complaint through the New Jersey Division of Consumer Affairs or the (CFPB). Both platforms allow you to report unfair practices effectively.

What is the statute of limitations for debt collection in New Jersey?** **?

The statute of limitations for most consumer debts in New Jersey is six years, which may be reset under certain conditions. Additionally, judgments have a statute of limitations of 20 years.

What actions can debt collectors legally take in New Jersey?** **?

Debt collectors in New Jersey can legally contact you via phone and other means. If necessary, they may pursue legal action, which can lead to wage garnishments, bank account withdrawals, or liens on real estate.

When should I seek legal help for debt-related issues?** **?

You should seek legal help for debt-related issues if you are being sued over a debt; a lawyer can help you understand your rights and formulate a defense. Taking this step ensures your interests are protected during the litigation process.