Payday Loan

Understanding Payday Loan Debt: Risks, Laws, and Solutions

What is Payday Loan Debt?

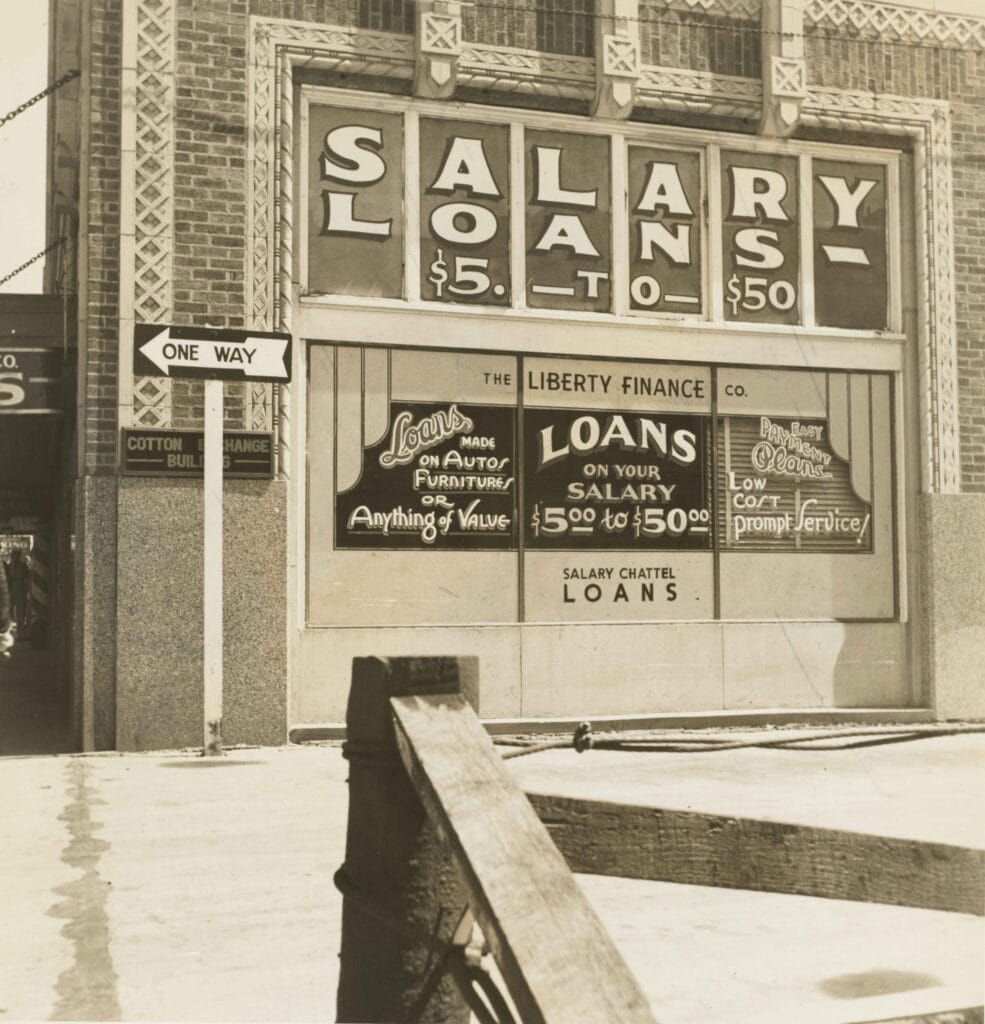

Payday loan debt arises from short-term, high-interest loans intended to provide quick cash advances until the borrower’s next paycheck. These loans are typically small, ranging from $100 to $1,500, and must be repaid within two weeks or one month. While payday loans are marketed as fast solutions for financial emergencies, they often lead to a cycle of debt due to their extremely high interest rates and fees.

How Payday Loans Work

Application Process: Borrowers apply online or at a storefront payday lender by providing proof of income, a checking account, and identification.

Loan Disbursement: If approved, the lender provides a cash advance or direct deposit, requiring repayment by the borrower’s next payday.

Repayment: The borrower either writes a postdated check or grants the lender electronic access to their bank account to withdraw the full amount due.

Rollover and Fees: If the borrower cannot pay the loan on time, they may roll it over into a new payday loan, incurring additional fees and interest.

Risks of Payday Loan Debt

High-Interest Rates: Many payday loans carry Annual Percentage Rates (APRs) of 300% to 700%, significantly higher than credit cards or personal loans.

Debt Cycle Trap: Due to short repayment terms and high fees, many borrowers take out new payday loans to cover the old ones, leading to a continuous debt cycle.

Aggressive Collection Practices: Some payday lenders use harassing phone calls, threats, and even illegal tactics to collect payments.

Impact on Credit Scores: While payday loans don’t typically appear on credit reports, unpaid loans that go into collections can damage credit scores.

Legal Protections for Borrowers

Consumers struggling with payday loan debt have legal protections, including:

State Regulations: Many states have laws that cap interest rates, limit loan amounts, or ban payday lending altogether.

Fair Debt Collection Practices Act (FDCPA): Protects borrowers from abusive or deceptive debt collection tactics.

Truth in Lending Act (TILA): Requires lenders to disclose all fees, APRs, and repayment terms before issuing a loan.

(CFPB): Enforces payday lending regulations and offers resources for borrowers to file complaints.

How to Get Out of Payday Loan Debt

Negotiate with the Lender: Some payday lenders may offer extended repayment plans or settlements to reduce the balance owed.

Debt Consolidation Loans: A low-interest personal loan from a bank or credit union can help pay off multiple payday loans at once.

Credit Counseling Services: Nonprofit credit counseling agencies provide budgeting assistance and debt management plans.

File a Complaint: If a payday lender engages in unlawful practices, borrowers can file complaints with the CFPB or their state attorney general’s office.

Alternatives to Payday Loans

Personal Loans from Banks or Credit Unions – Lower interest rates and longer repayment terms.

Credit Card Cash Advances – Typically lower APRs compared to payday loans.

Employer Pay Advance Programs – Some employers offer salary advances with no interest.

Local Assistance Programs – Charities and nonprofits provide financial aid for rent, utilities, and emergencies.

Conclusion

While payday loans may offer quick cash solutions, they come with significant financial risks. Understanding the costs, legal protections, and alternatives can help borrowers break free from payday loan debt and regain financial stability. If you are facing payday loan debt and need legal assistance, contact our law firm today for a consultation.