Understanding Minnesota debt collection laws is crucial for protecting your rights. This article will explain your rights, what debt collectors can and cannot do, and actions to take if collectors violate the law.

Key Takeaways

- Minnesota debt collection laws protect consumers from harassment and require debt collectors to disclose their licensing status and provide transparent communication.

- Consumers have rights, including receiving written notice of debts and the ability to sue debt collectors for legal violations, with agencies like the Minnesota Department of Commerce offering assistance in complaints.

- Understanding permissible debt collection practices and state-specific protections, such as statutes of limitations and wage garnishment laws, is essential for consumers to effectively manage their financial rights.

Understanding Minnesota Debt Collection Laws

Minnesota’s debt collection laws ensure that debt collectors operate transparently and adhere to fair practices. Key aspects include:

- Protection of consumers from harassment, threats, and deceptive practices.

- Requirement for collection agencies to disclose their licensing status in initial communications to ensure transparency.

- Prohibition of deceptive practices or threats used by debt collectors to intimidate consumers.

This framework ensures that consumers have the right to be treated fairly and free from harassment by authorized debt collectors.

The Minnesota Department of Commerce plays a crucial role in regulating debt collectors and ensuring compliance with these laws. Understanding these regulations helps consumers protect themselves and their financial well-being when dealing with unpaid debt and collection agencies.

How the FDCPA Aligns with Minnesota Law

The Fair Debt Collection Practices Act (FDCPA) works alongside Minnesota’s state laws to reinforce consumer protections against abusive debt collection practices. This alignment ensures that debt collectors must provide clear disclosures regarding the nature of the debt when first contacting consumers. Requiring transparency and honesty, both the FDCPA and Minnesota law aim to prevent misleading communication and the use of false legal documents by debt collectors.

The Minnesota Attorney General and the Minnesota Department of Commerce monitor and enforce these regulations, ensuring debt collectors operate within the legal framework. This dual-layered protection helps safeguard consumers from unfair debt collection practices, emphasizing the importance of understanding both federal and state laws.

Your Rights When Dealing with Debt Collectors

Minnesota debt collection laws are designed to protect consumers from harassment, threats, and deceptive practices by debt collectors. These laws regulate third-party debt collection agencies and debt buyers operating within the state, ensuring they adhere to fair debt collection practices. The Fair Debt Collection Practices Act (FDCPA) supplements these protections by setting strict requirements for collectors to follow, including prohibitions against abusive practices.

Consumers have the right to receive a written notice from debt collectors stating the amount owed and the collector’s identity. If sued by a debt collector, consumers can demand verification of the debt to ensure its legitimacy.

Additionally, the Minnesota Department of Commerce provides assistance with complaints regarding debt collection practices, investigating consumer complaints to ensure compliance with regulations.

Actions to Take if a Debt Collector Breaks the Law

If a debt collector violates the law, consumers have several avenues for recourse. One option is to file a complaint with the Minnesota Department of Commerce or the (CFPB). These agencies investigate complaints and take action to ensure compliance with fair debt collection practices.

Consumers also have the right to sue debt collectors for damages in federal court if they violate the Fair Debt Collection Practices Act (FDCPA). This legal action must be taken within one year of the violation.

Knowing these steps allows consumers to effectively protect their rights and seek justice if a debt collector breaks the law.

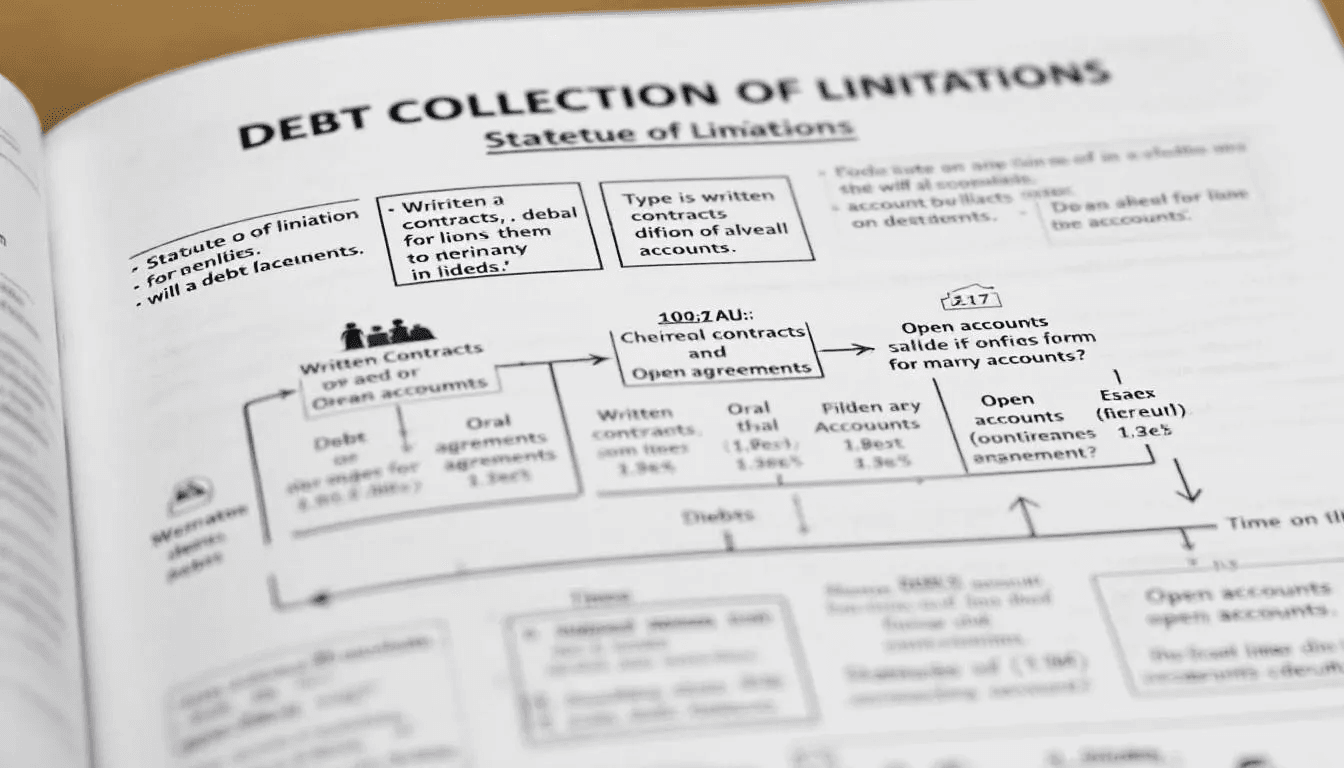

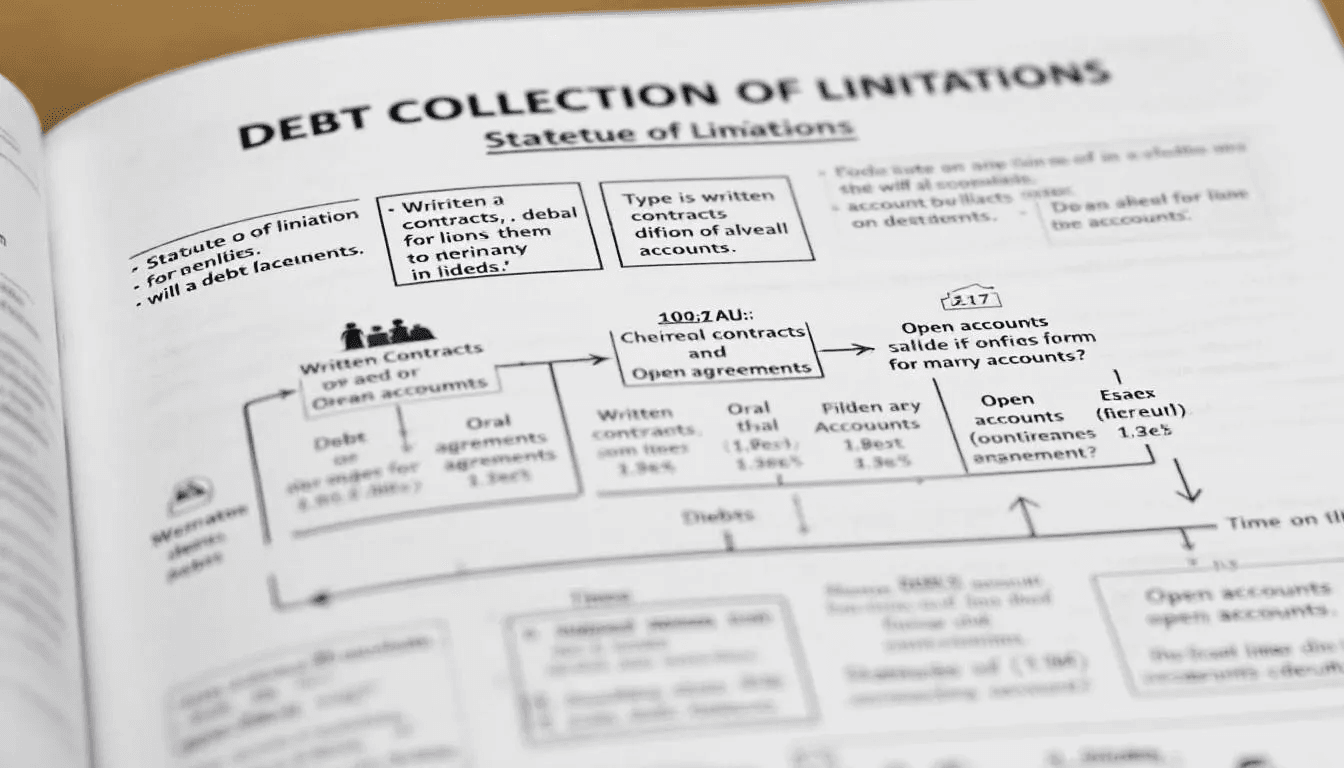

Statute of Limitations for Debt Collection in Minnesota

In Minnesota, the statute of limitations for debt collection varies depending on the type of debt. For credit card and medical bill debt, the statute of limitations is six years. For personal or household debt, the statute of limitations is four years. This time limit refers to the period during which debt collectors can initiate legal action to collect a debt.

Knowing these time limits helps consumers understand their rights and defenses against expired debts. Once the statute of limitations has passed, debt collectors are legally barred from taking court action to collect the limited debt.

Responding to Debt Collection Lawsuits

If a debt collector files a lawsuit after the statute of limitations has expired, it is essential to assert this defense in your response. Responding to the lawsuit and raising the statute of limitations as a defense can protect you from being unfairly pursued for an old debt.

Additionally, it’s crucial to require proof of the debt when sued by a debt collector, ensuring that the debt is legitimate and within the legal time frame. Knowing your rights and the appropriate responses helps you effectively defend yourself against debt collection lawsuits and protect your financial interests.

Permissible Debt Collection Practices in Minnesota

Debt collectors in Minnesota are permitted to:

- Contact individuals via phone, email, social media, and other communication methods.

- Initiate legal action to recover debts.

- Enforce collection through wage garnishment if they obtain a court verdict.

- Place a lien on the debtor’s property.

The Minnesota Department of Commerce ensures that the debt collection agency adheres to these legal standards and regulations, including obtaining a state license.

Understanding permissible debt collection practices helps consumers recognize when a debt collector is collecting within the law and when they may be overstepping their bounds.

Repossession of Vehicles in Minnesota

In Minnesota, debt collectors can repossess various types of vehicles without a court order, provided they do not breach the peace during the process. These vehicles include:

- Cars

- Trucks

- Motorcycles

- ATVs

Creditors have a security interest in these vehicles, allowing them to repossess them after missed payments.

Understanding these rights and procedures can help consumers navigate the repossession process and protect their interests.

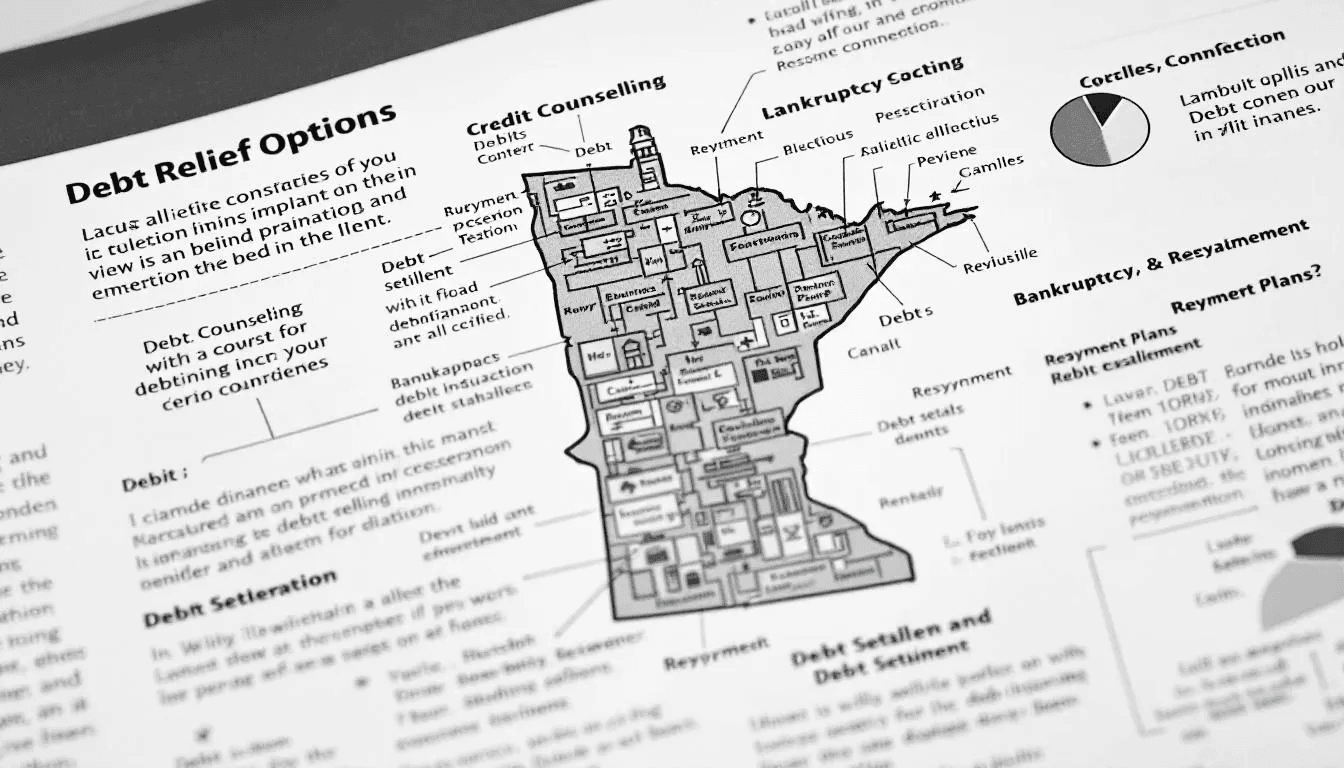

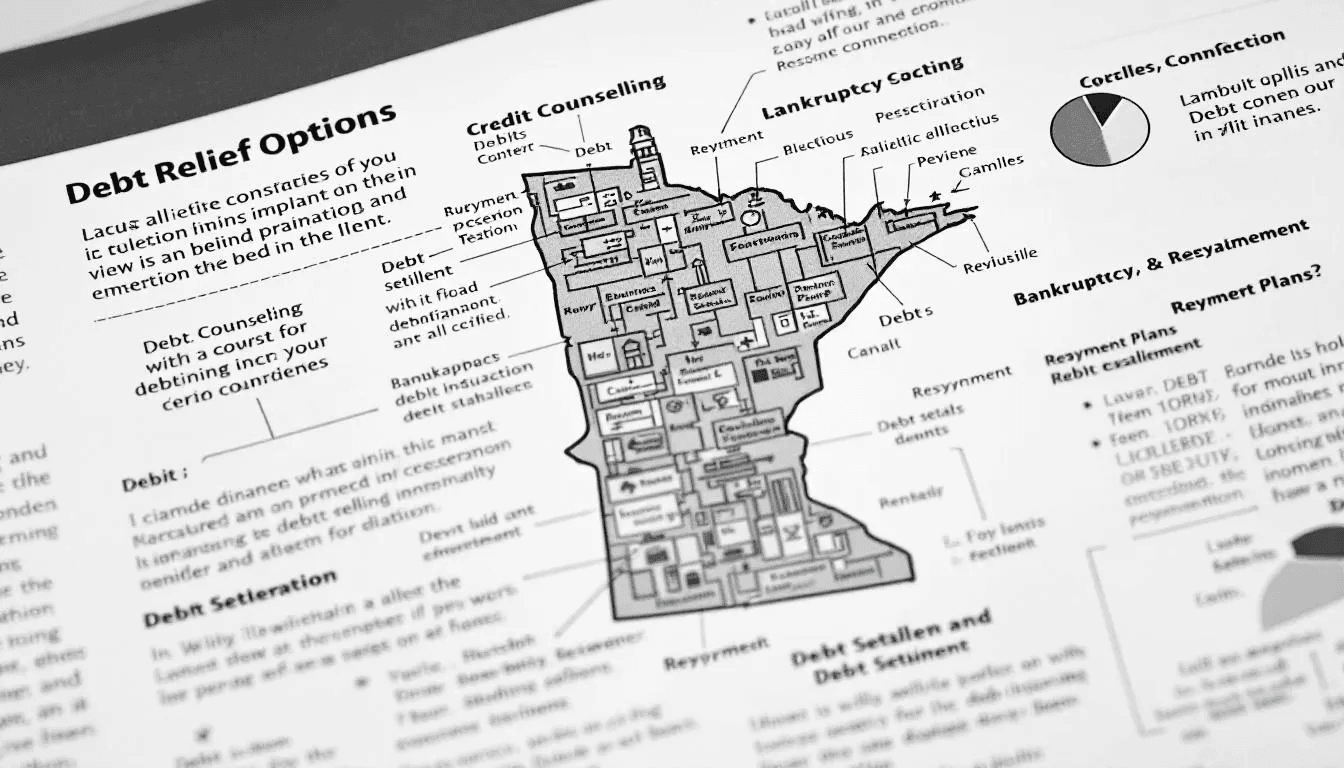

Options for Debt Relief in Minnesota

Minnesota offers various debt relief methods to help residents manage financial difficulties. These options include:

- Credit counseling

- Debt management plans

- Consolidation loans

- Bankruptcy

Bankruptcy, in particular, can effectively halt bank collection actions and provide a fresh business money financial start.

Consumers should explore these options to determine the best strategy for their finances, potentially reducing their debt burden and improving their financial health.

Seeking Help from Credit Counselors

Licensed credit counselors in Minnesota provide assessments of your financial situation and explain various debt relief strategies available. They are equipped to evaluate financial situations and suggest tailored debt relief strategies, including setting up repayment plans. Debt management plans allow individuals to make a single monthly payment while creditors receive negotiated lower interest rates.

Seeking help from credit counselors provides consumers with personalized assistance in managing their debts and improving their financial stability.

Debt Consolidation Programs

Debt consolidation in Minnesota:

- Simplifies multiple debts into a single loan

- Often offers lower interest rates

- Allows for easier management

- Reduces the number of monthly payments

This consolidation can simplify pay by merging multiple debts into a single loan, potentially lowering overall interest rates.

For those struggling with multiple debts, consolidation programs provide a practical solution to streamline payments and reduce financial stress.

Wage Garnishment Laws in Minnesota

In Minnesota, wage garnishments are permitted for specific debts, but the law limits the amount that can be garnished to protect a portion of the debtor’s income. The maximum portion of disposable earnings that can be garnished varies based on the debtor’s weekly income compared to established thresholds, ranging from 10% to 25%. Additionally, certain types of income, like Social Security benefits, are generally exempt from garnishment to protect essential funds.

Understanding wage garnishment laws helps consumers protect their income and navigate the garnishment process effectively.

Protecting Your Wages from Garnishment

Certain income types, like Social Security or unemployment benefits, are typically protected from garnishment. This means creditors cannot claim these funds. If your wages are garnished, you can legally contest the garnishment or claim exemptions for specific types of income.

Taking these steps helps consumers protect their essential funds and reduce the financial impact of wage garnishment.

Filing Complaints Against Debt Collectors

Consumers can file complaints against debt collectors through the Minnesota Attorney General’s office using an online portal dedicated to addressing such issues. The Attorney General’s office investigates complaints to ensure that debt collectors comply with state laws. Documentation of communications and any violations is essential for filing a complaint against a debt collector.

Knowing the complaint process enables consumers to effectively address violations and protect their rights.

Minnesota Department of Commerce’s Role

The Minnesota Department of Commerce is responsible for regulating debt collection agencies and ensuring compliance with applicable laws. Consumers can communicate directly with investigators while their complaints are being processed.

The Department handles consumer complaints against debt collectors to protect consumers’ rights and maintain fair practices and accountability among debt collectors.

Impact of Debt Collection on Your Credit Report

Unpaid debts can significantly harm your credit score, making it harder to obtain loans or credit in the future. Debt collection activities can result in negative marks on your credit report, which may remain for several years. Consumers have the right to dispute any inaccuracies in their credit reports resulting from debt collection efforts.

Understanding the impact of debt collection on your credit report is crucial for maintaining your financial health and taking steps to correct any errors.

Correcting Errors on Your Credit Report

To correct errors, individuals can:

- File a dispute with the credit bureau that provided the report.

- Contact both the credit bureau and the creditor that provided the erroneous information.

- File disputes online, by mail, or by phone.

It’s crucial to document your writing correspondence as a person.

Taking these steps ensures that consumers’ credit reports accurately reflect their financial situation, allowing them to take control of their credit health.

Summary

Understanding Minnesota debt collection laws is essential for protecting your financial rights and navigating the complexities of debt collection. From recognizing permissible practices to knowing how to respond to violations, this guide equips you with the knowledge needed to manage your financial health effectively. Remember, you have rights and options available to help you take control of your debt and improve your financial stability.

Frequently Asked Questions

What are the collection laws in Minnesota?

In Minnesota, debt collectors must provide a written notice within five days of their initial contact, detailing the debt amount and creditor’s name. Additionally, they are prohibited from harassing or abusing individuals in any form, ensuring respectful communication throughout the collection process.

What should I do if a debt collector breaks the law?

If a debt collector breaks the law, it is advisable to file a complaint with the relevant authorities, such as the Minnesota Department of Commerce or the . Additionally, consider pursuing legal action for damages in federal court. Taking these steps can help protect your rights and seek accountability.

How long is the statute of limitations for debt collection in Minnesota?

In Minnesota, the statute of limitations for debt collection is six years for credit card and medical bill debts, and four years for personal or household debts. It is important to be aware of these time limits when dealing with debt collection.

What are my rights when dealing with debt collectors?

You have the right to receive a written notice detailing the amount owed and the collector’s identity, and you can request verification of the debt if necessary. It is crucial to be aware of these rights to protect yourself when dealing with debt collectors.

How can I protect my wages from garnishment?

To protect your wages from garnishment, contest the garnishment legally and claim exemptions for specific income sources, such as Social Security benefits. Taking these actions can help safeguard your financial stability.