Ohio debt collection laws protect you from unfair practices, whether dealing with original creditors or third-party debt collectors. Knowing these laws helps you manage your debt and ensures your rights are safeguarded.

Key Takeaways

- Ohio residents are protected by both federal and state laws, such as the FDCPA and OCSPA, which govern debt collection practices and ensure fairness.

- Understanding the statute of limitations for different types of debt—six years for general debts and four years for medical debts—is essential for managing financial obligations and protecting against legal actions.

- Consumers have the right to dispute debts, seek validation from collectors, and report illegal practices to the CFPB, ensuring their rights are upheld during debt collection processes.

Understanding Ohio Debt Collection Laws

Ohioans enjoy protections from the federal Fair Debt Collection Practices Act (FDCPA). Additionally, they are safeguarded by the Ohio Consumer Sales Practices Act (OCSPA). Knowing your rights and options under these laws helps in managing debt efficiently and ensures fair treatment by debt collectors.

Ohio residents should be aware of these protections to guard against unfair and deceptive practices, whether from third-party debt collectors or original creditors, to prevent fraud.

Federal Fair Debt Collection Practices Act (FDCPA)

The FDCPA is a federal law specifically designed to regulate the actions of third-party debt collectors, ensuring they do not engage in misleading or abusive practices. Under this law, debt collectors cannot contact consumers at inconvenient times or places, specifically outside 8 AM to 9 PM local time.

The act also prohibits using postcards to communicate about a debt and mandates that collectors provide clear and accurate information about the debt. The FDCPA, enforced by the (CFPB), is a crucial part of federal consumer protection laws, ensuring fair debt collection practices and protecting consumers from unfair practices.

Ohio Consumer Sales Practices Act (OCSPA)

The OCSPA extends consumer protections to original creditors, in addition to third-party debt collectors. This state law aims to protect consumers from unfair and deceptive sales practices, requiring original creditors to engage in fair practices when collecting debts from consumers and ensuring that each creditor adheres to these standards.

The OCSPA works in conjunction with federal laws to ensure Ohio residents are comprehensively protected against unfair debt collection practices.

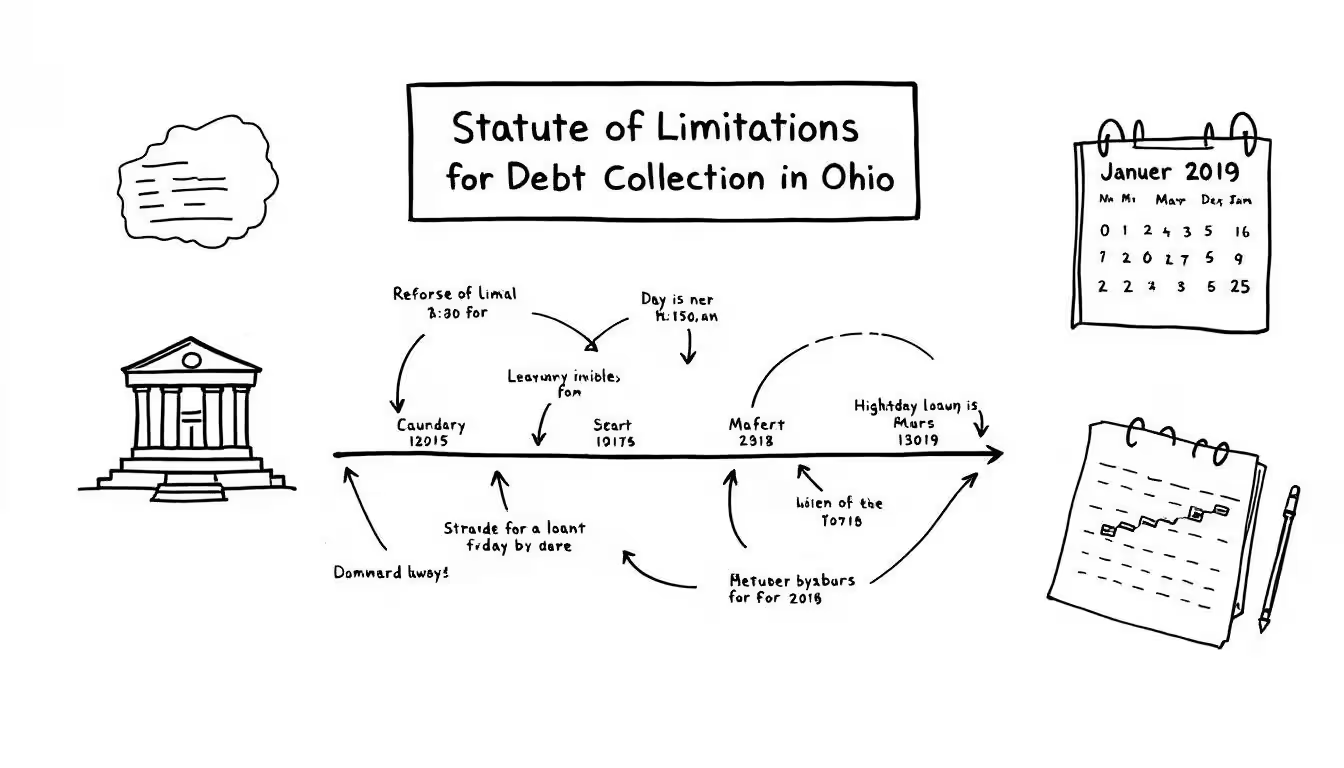

Statute of Limitations for Debt Collection in Ohio

In Ohio, creditors can no longer take legal action to collect a debt once the statute of limitations has expired. This time limit varies depending on the type of debt, and understanding these limits is essential for protecting yourself from unwarranted legal actions.

Admitting to a debt or making a partial payment can reset the statute of limitations, extending the time creditors have to collect. Knowing these timeframes can help you manage your financial obligations more effectively and avoid unnecessary legal battles.

General Debts

In Ohio, the statute of limitations for general debts is six years. This applies to credit card debt as well. This period begins when the debt became overdue or from the last payment made. If the statute of limitations period exceeds six years, creditors cannot sue for debt collection.

Knowing this timeframe helps in managing your financial obligations and recognizing when a debt owed is no longer legally enforceable.

Medical and Specific Contract Debts

The statute of limitations for medical debt in Ohio is four years. This shorter timeframe compared to general debts highlights the importance of understanding the specific limits for different types of debt.

Understanding the statute of limitations for medical debts helps you recognize your rights and obligations during debt collection processes in Ohio.

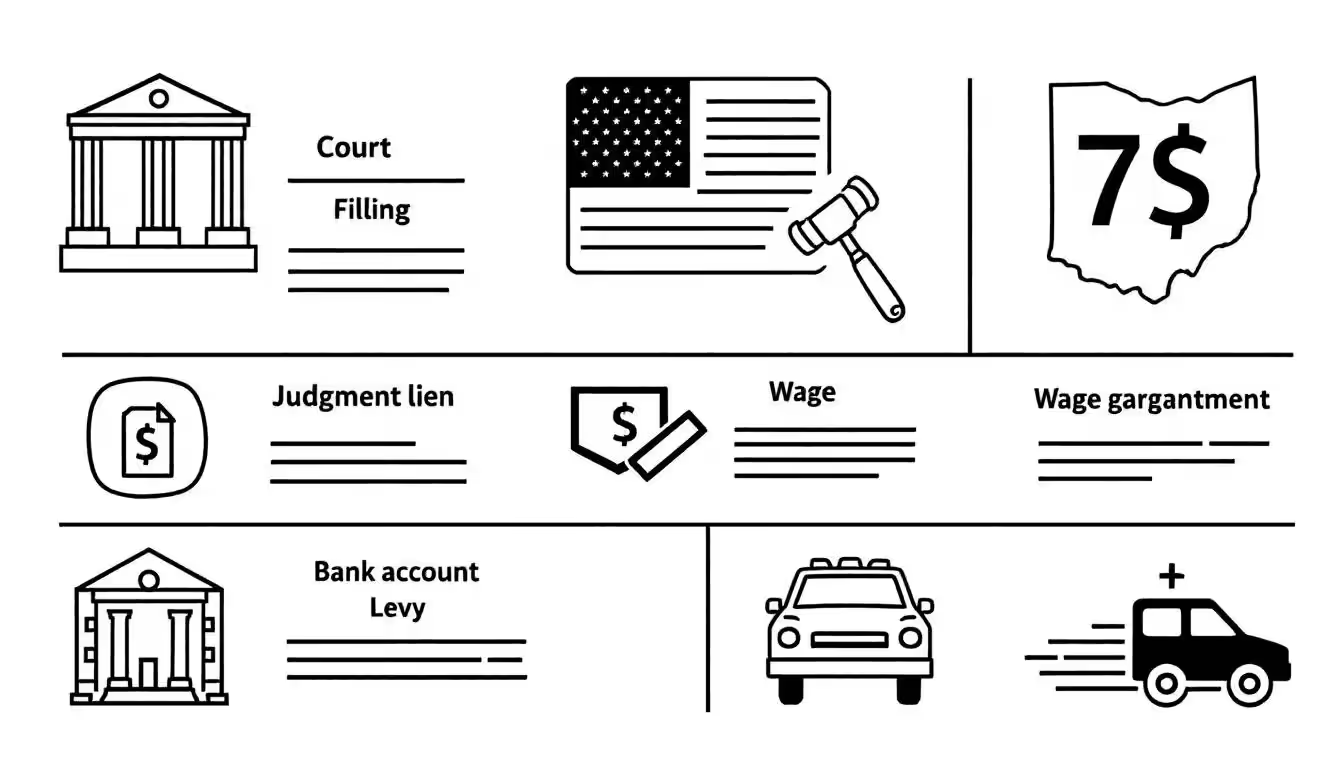

Legal Actions Debt Collectors Can Take in Ohio

Debt collectors in Ohio have several legal actions at their disposal to secure payment for debts:

- They may initiate lawsuits to collect debts.

- Lawsuits can lead to more severe collection methods like wage garnishment or placing liens on property.

- Failure to respond to these lawsuits can result in a default judgment.

- A default judgment allows creditors to collect the debt through various means.

Being aware of these potential actions helps you prepare and respond appropriately to avoid severe financial consequences.

Responding to a Debt Collection Lawsuit

Responding to a debt collection lawsuit is crucial to avoid losing the case by default. You must file a response within 28 days of being served with a lawsuit. In your response, you should admit, deny, or indicate insufficient information regarding each claim raised in the lawsuit.

These steps help protect your rights and prevent a default judgment, which could lead to wage garnishment or other severe actions.

Default Judgment

Ignoring a debt collection lawsuit can result in a default judgment against you. This judgment allows creditors to take further actions such as garnishing your wages, freezing bank accounts, or placing liens on your property.

Even if you believe the statute of limitations has expired, you must respond and present your case in court with a lawyer to avoid these severe consequences.

Consumer Rights When Dealing with Debt Collectors

Consumers in Ohio are protected by both federal and state laws from abusive debt collection practices. These protections, under the FDCPA and OCSPA, are designed to ensure fair treatment and prevent harassment, abuse, and deception by debt collectors.

Knowing these rights helps effectively manage interactions with debt collectors and safeguards against unlawful practices.

Protection Against Harassment

The FDCPA establishes protections for consumers against abusive debt collection practices. The following are prohibited:

- Harassment

- Use of violence

- Obscene language

- Repeated phone calls

- Use of profane language

- Threatening you with jail time

- Making threats of violence

These protections ensure consumers are treated fairly and without undue stress or intimidation, following the rules.

Right to Dispute Debt

Consumers in Ohio have the right to challenge the validity of a debt and request verification from the debt collector. This process ensures transparency in the debt collection process and protects consumers from paying debts they do not owe.

Upon receiving a debt validation request, collectors are required to provide evidence that the debt is collected and belongs to the consumer.

What To Do If a Debt Collector Violates Your Rights

If a debt collector violates your rights, there are several steps you can take to address the situation. Consumers must receive a validation notice from the debt collector within five days of the first contact, detailing the amount owed and the creditor’s name. Once you receive this notice, you have 30 days to formally dispute the debt if you believe it is incorrect.

Reporting a violation to the Ohio Attorney General’s office or the (CFPB) can initiate investigations and protect your rights. A report can help in this process.

Filing a Complaint

Complaints regarding debt collection practices can be submitted to the CFPB through their official website. The CFPB allows consumers to submit complaints against debt collectors for unlawful practices, helping to address these issues and protect consumer rights.

Submitting a complaint can result in investigations and potential resolutions of unlawful practices by debt collectors.

Seeking Legal Recourse

Consumers can file a lawsuit in small claims court for debts under a specified amount, making legal recourse accessible for smaller claims. Filing a lawsuit can lead to compensation, which may cover not only actual damages but also punitive damages to deter future violations. If consumers are not satisfied with the outcome, they may feel they have been wronged and consider being sued. The lawsuit can be filed in court.

This legal action helps protect your rights and hold many debt collectors accountable.

Practical Tips for Managing Debt in Ohio

Effective debt management involves:

- Creating a budget, which helps identify spending patterns and areas for cost-cutting, facilitating debt repayment.

- Timely bill payments.

- Exploring debt relief options.

Ohio offers a variety of assistance programs, including credit counseling and financial education services, to help individuals manage their financial obligations and avoid overdue payments.

Communicating with Creditors

Clear and respectful communication with creditors can lead to better negotiation outcomes. Contacting creditors directly can result in hardship programs that may lower interest rates or fees temporarily. This proactive approach helps manage debts more effectively and prevent further financial stress.

Avoiding Admission of Debt

In Ohio, acknowledging a debt or making a partial payment can reset the statute of limitations, allowing collectors more time to pursue the debt. Consumers should be cautious in communications with debt collectors, as admitting the validity of a debt can lead to legal consequences.

Keeping records of all communication with debt collectors helps individuals avoid inadvertently admitting to debts.

Resources for Debt Relief in Ohio

Ohio offers various resources for debt relief, including nonprofit credit counseling, debt management plans, and bankruptcy options. These resources provide Ohio residents with the support needed to manage their debts effectively and regain financial stability for the nation.

Nonprofit Credit Counseling

Nonprofit agency like InCharge assist Ohio residents by consolidating debts into manageable monthly payments through structured plans. These company agencies offer services to help individuals manage their debt effectively and regain financial control.

Debt Management Plans

Debt management plans can simplify payments by consolidating multiple debts into a single monthly payment. Individuals enrolling in these plans may need to commit to not incurring new debt during the program’s duration.

These plans help individuals make manageable pay to creditors and reduce financial stress, ensuring that they pay debts and their debts are paid.

Bankruptcy Options

In Ohio, individuals have the option to file for Chapter 7 or Chapter 13 bankruptcy, which can provide significant relief from overwhelming debts. Chapter 7 bankruptcy allows for the discharge of unsecured debts, while Chapter 13 involves creating a repayment plan over three to five years.

These options help individuals make informed decisions about managing their financial money obligation.

Summary

Navigating debt collection laws in Ohio can seem daunting, but understanding your rights and obligations can make a significant difference. Ohio residents are protected by both federal and state laws designed to ensure fair debt collection practices. Knowing the statute of limitations for different types of debt, understanding the legal actions debt collectors can take, and being aware of your rights when dealing with debt collectors are all crucial steps in managing your finances. By taking advantage of resources like nonprofit credit counseling, debt management plans, and understanding bankruptcy options, Ohio residents can find effective ways to handle their debts. Empowering yourself with this knowledge can help you face debt collectors with confidence and take control of your financial future.

Frequently Asked Questions

What is the statute of limitations for credit card debt in Ohio?

The statute of limitations for credit card debt in Ohio is six years, beginning from the date the debt became overdue or the last payment was made. It is crucial to be aware of this timeframe when addressing outstanding credit card obligations.

What should I do if a debt collector harasses me?

If a debt collector harasses you, it is crucial to report the violation to the appropriate authorities, such as the Ohio Attorney General’s office or the . Consider filing a lawsuit for damages under the Fair Debt Collection Practices Act. Taking these actions will help protect your rights and hold the collector accountable.

How can I dispute a debt?

To dispute a debt, send a written request to the debt collector for verification, and they are required to provide evidence that the debt is valid and belongs to you. Ensure your request is clear and documented to protect your rights.

What are the consequences of a default judgment?

A default judgment can result in wage garnishment, freezing of bank accounts, or liens on your property. It is imperative to respond to debt collection lawsuits to prevent these serious repercussions.

What resources are available for debt relief in Ohio?

Ohio residents can utilize nonprofit credit counseling, debt management plans, and bankruptcy options as resources for debt relief, aiding in managing debts and achieving financial stability.