Rhode Island debt collection laws protect consumers from unfair practices. This article explains these laws, your rights, and the statute of limitations on debt.

Key Takeaways

- Rhode Island debt collection laws prioritize consumer protection, enforcing strict practices against harassment and unethical behavior by debt collectors.

- The statute of limitations for most unsecured debts is ten years in Rhode Island, while judgments can be pursued for up to twenty years, highlighting the importance of managing debt timelines.

- Consumers have specific rights under Rhode Island law, including the right to request debt validation and report illegal practices, which aids in safeguarding their financial interests.

Understanding Rhode Island Debt Collection Laws

Rhode Island’s debt collection laws aim to balance the interests of creditors and debtors, promoting ethical practices and shielding consumers from abusive tactics. The Rhode Island Debt Collection Practices Act, with its fourteen sections, spells out the dos and don’ts for debt collectors. It prohibits revealing the nature of your debt to friends or family, thereby maintaining your privacy.

Federal laws, such as the Fair Debt Collection Practices Act (FDCPA), augment Rhode Island’s laws with extra safeguards against unethical collection methods. Violating these laws can result in severe penalties, including fines, imprisonment, and registration revocation for debt collectors.

Together, these federal and state laws shield consumers against unfair practices, setting a high bar for ethical debt collection.

Statute of Limitations on Debt in Rhode Island

The statute of limitations is a key component of Rhode Island’s debt collection laws, determining how long creditors can pursue collection actions. The time frames vary based on the type of debt, offering different durations for different financial obligations.

Once the statute of limitations expires, debt collectors lose the legal right to sue for the debt. Most unsecured debts, like credit card debt, have a ten-year statute of limitations.

Judgments, or debts confirmed by a court, have a twenty-year collection window. Some debts, such as federal student loans and back child support, lack a statute of limitations, allowing creditors to pursue them indefinitely.

General Debts

For most general debts in Rhode Island, the statute of limitations is set at ten years. This includes a wide range of debts such as credit card balances, medical bills, and personal loans.

Making payments on a debt during this period can reset the statute of limitations, restarting the clock and giving creditors more time to collect. Even a partial payment can extend the collection period by another ten years.

If you stop payments after resetting the statute of limitations, the clock resumes, potentially altering the debt collection timeline. Knowing this aids in making informed decisions about debt management.

Judgments

When a debt is taken to court and a judgment is obtained, the statute of limitations for collection in Rhode Island extends to twenty years. This significantly longer period gives creditors an extended window to enforce the judgment through various legal means.

Judgments can be renewed, extending the collection period further; notwithstanding this, it highlights the importance of promptly addressing court judgments and understanding their long-term financial implications.

Debts Without a Statute of Limitations

Certain types of debts, such as federal student loans and back child support, do not have a statute of limitations. This means that creditors can pursue collection efforts indefinitely, without any legal time constraints. These debts are often linked to government obligations or specific financial responsibilities, making them exceptions to general debt collection rules.

Knowing that these debts can be pursued indefinitely is essential for long-term financial planning and management.

Consumer Protections Under Rhode Island Law

Rhode Island’s laws provide robust protections for consumers against abusive debt collection practices. The Rhode Island Debt Collection Practices Act specifies prohibited behaviors to ensure fair treatment of consumers. This includes requirements for debt collectors to validate debts upon request and bans on harassment and deceptive practices.

Consumers have the right to initiate legal action against debt collectors who violate these laws, with potential penalties including fines and revocation of the collector’s registration. Understanding these protections helps consumers navigate interactions with debt collectors and safeguard their rights.

Prohibited Actions by Debt Collectors

Rhode Island law explicitly bans several actions by debt collectors to protect consumers, including:

- Harassment, such as threats of illegal actions and obscene language

- Using threats of violence

- Publishing a debtor’s name

- Demanding post-dated checks

Collectors are restricted from:

- Misrepresenting the amount owed

- Falsely claiming to be attorneys

- Collecting unauthorized amounts

- Making calls outside of 8 AM to 9 PM

These restrictions aim to prevent unfair practices and protect consumers from undue pressure.

Rights of Consumers

Consumers in Rhode Island have several rights when dealing with debt collectors:

- They are entitled to clear communication about their debts.

- They must be informed of any violations of the law during collection attempts.

- They have the right to request debt validation within 30 days of first contact, ensuring the claim’s legitimacy.

Documenting all communication with debt collectors is vital for establishing a clear record and is crucial if disputes arise. Consumers can report any violations to state authorities or consumer protection agencies to ensure their rights are upheld.

Responding to Debt Collection Attempts

Responding to debt collection attempts can be intimidating, but knowing your legal protections is crucial. Debt collectors are prohibited from using unfair means, such as threats to publish a consumer’s name or debt details.

Understanding your rights and reporting any unfair practices can protect you during this process.

Validating the Debt

Under Rhode Island law, consumers can dispute a debt and require the collector to validate it before further collection attempts. To initiate this, send a written notice to the debt collector within 30 days of the initial communication, stating your reasons for the dispute.

Requesting debt validation compels collectors to prove the debt’s legitimacy and their right to collect it. This step ensures you only pay what you legitimately owe and that the collector has accurate information.

Disputing the Debt

If you believe a debt is incorrect or invalid, disputing it is crucial. Consumers can:

- Formally demand that debt collectors stop communication until the debt is verified.

- Use this time to gather evidence.

- Assess the legitimacy of the debt without ongoing harassment.

Pausing communication provides respite and ensures any payments made are accurate and justified. Disputing debts can protect you from paying money you do not owe and from unjust collection practices.

Tolling and Its Impact on Debt Collection

Tolling is a legal concept that impacts debt collection by pausing or delaying the statute of limitations, extending the period creditors can pursue collection. The meaning of this can occur for various reasons, such as when a debtor requests more time to settle the debt or certain legal conditions are met.

Understanding tolling is important as it can alter the debt collection timeline, giving creditors more time to take legal action. This knowledge helps in navigating interactions with creditors and managing financial obligations.

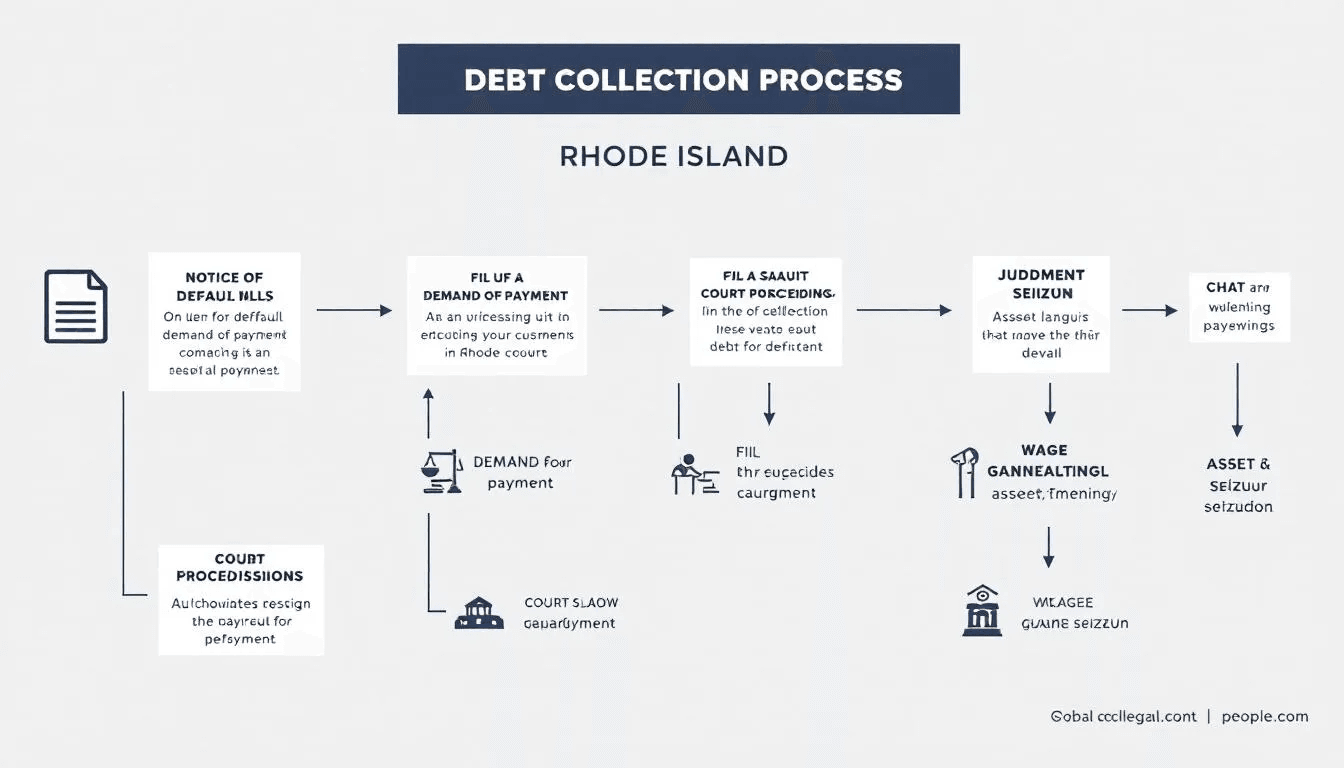

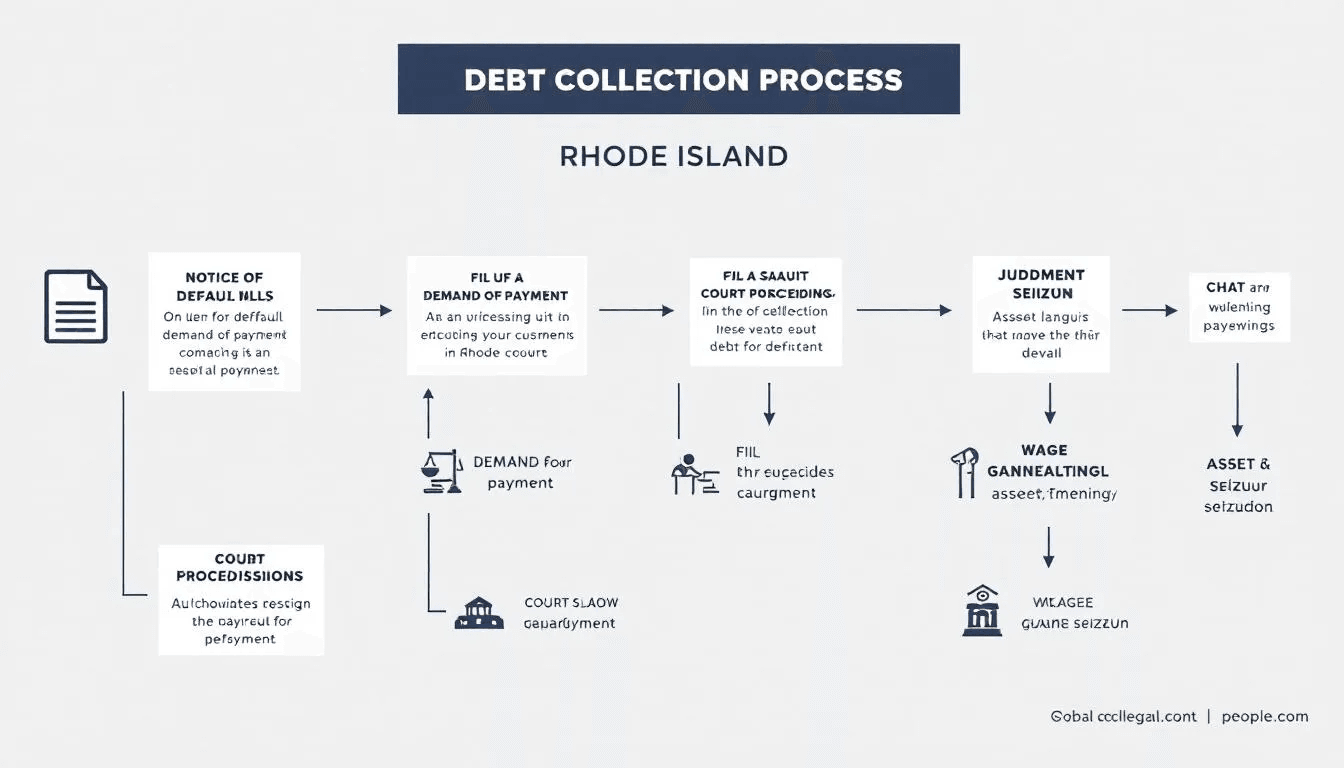

Legal Process for Debt Collection in Rhode Island

The legal process for debt collection in Rhode Island involves several steps:

- Creditors have ten years to file lawsuits for most debts.

- The filing period extends to twenty years for judgments.

- If a default judgment is entered, act quickly to seek to open or strike it within ten days.

Engaging a debt collection attorney offers significant advantages:

- They possess specialized knowledge about debt collection laws and procedures, ensuring compliance and protecting creditors from legal risks.

- They can assist in enforcing judgments.

- They improve the chances of successful debt recovery.

Avoiding Default Judgments

Avoiding default judgments is critical for protecting your financial health. In Rhode Island:

- Consumers have 20 days to respond to a debt collection lawsuit.

- Failing to respond within this period can lead to a default judgment.

- A default judgment means the court accepts all facts in the complaint as true, regardless of their accuracy.

A default judgment can result in severe financial consequences, including liens on real property and asset seizures. Engaging an attorney promptly after being served with a lawsuit can help protect your rights and ensure appropriate responses.

Working with an Attorney

Hiring an attorney for debt collection issues offers numerous benefits:

- It allows creditors to save time and resources, focusing on their primary business activities.

- An attorney provides expertise and strategic guidance in navigating debt collection laws and negotiations.

- This expertise improves outcomes.

Legal representation ensures compliance with laws, protecting you from legal risks and enhancing the likelihood of recovering owed debts. Working with an attorney can significantly impact the success of debt collection efforts and protect your interests.

Summary

Understanding Rhode Island’s debt collection laws is essential for both consumers and creditors. These laws provide critical protections against abusive practices and outline clear guidelines for ethical debt collection. From the statute of limitations to consumer rights and the legal process, being informed empowers you to navigate debt collection confidently.

Whether you are dealing with a debt collector or managing financial obligations, this guide has provided the tools and knowledge to protect your financial well-being. Remember, seeking legal help can offer additional protection and improve outcomes. Stay informed, know your rights, and take proactive steps in managing your debts.

Frequently Asked Questions

What is the 7 7 7 rule for collections?

The 7 7 7 rule for collections prohibits debt collectors from making more than seven calls to a consumer about a specific debt within a seven-day period, and they cannot initiate any call within seven days after a telephone conversation regarding that debt. This rule aims to protect consumers from excessive communication from collectors.